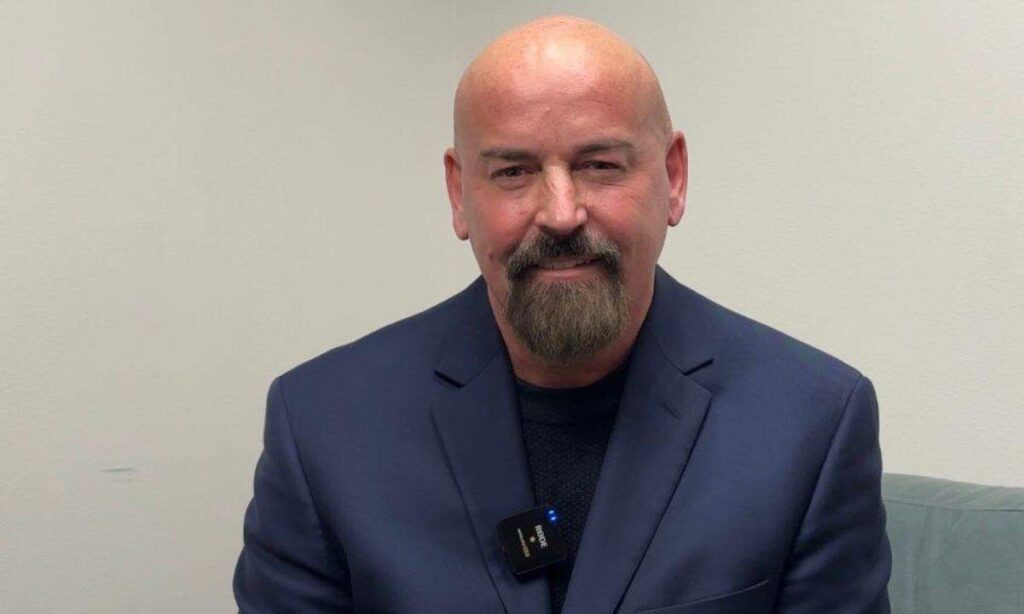

Investor and podcast host Jason Calacanis has reignited debate over XRP’s classification, calling the token a “centrally managed safety” in a current publish on X.

Calacanis questioned whether or not XRP needs to be thought of decentralized, stating that if the Securities and Alternate Fee (SEC) permits it to commerce like Bitcoin, then securities legislation will probably be nugatory.

Calacanis Warns of Market Chaos

In his post, the podcast host warned that treating XRP like Bitcoin may create instability, permitting startups and funding funds to dump massive quantities of tokens onto retail buyers.

“There will probably be chaos within the markets as 1,000,000 startups, funds and grifters begin dumping 50% of their cash on retail whereas slowly promoting the 50% they personal and management.”

He additional argued that such instability would hurt the U.S., a rustic identified for its structured and investor-friendly markets. To stop this, he steered limiting XRP buying and selling to people who move a “refined investor check,” guaranteeing they perceive the dangers earlier than investing.

One other consumer argued that Trump prioritizes alternatives for big buyers over defending retail buyers, citing his strategy to the CFPB and related regulatory companies.

Calacanis’ remarks have gotten criticism, notably from John Deaton, founding father of Crypto Regulation. Deaton responded by sharing a doc that argues XRP doesn’t meet the authorized definition of an funding contract below the Howey Check.

In line with him, the token isn’t a “contract, transaction, or scheme,” which instantly opposes the investor’s argument.

Regulatory Uncertainty and Implications

The controversy comes amid ongoing regulatory uncertainty surrounding XRP. In August 2023, Ripple secured a victory when a U.S. courtroom dominated that the token isn’t a safety when traded on secondary markets. Nonetheless, the SEC later appealed the ruling, sustaining that the corporate violated securities legal guidelines in its gross sales to retail buyers.

The result of the lawsuit and potential regulatory modifications below the Trump administration may considerably affect XRP’s standing. Bloomberg ETF analyst James Seyffart has pointed out that Commissioner Hester Peirce’s Crypto Job Drive might reassess its classification by the tip of 2025.

Lawyer Jeremy Hogan has additionally weighed in with the identical sentiment adding that an XRP exchange-traded fund (ETF) is unlikely to be accepted till the regulator’s lawsuit is resolved.

There has additionally been hypothesis concerning the coin’s potential inclusion in a U.S. nationwide crypto reserve.

Rumors started circulating after Trump met with Ripple CEO Brad Garlinghouse and Chief Authorized Officer Stuart Alderoty for dinner on January 6. Nonetheless, the case’s end result will seemingly decide whether or not XRP might be thought of for such a task.

Binance Free $600 (CryptoPotato Unique): Use this link to register a brand new account and obtain $600 unique welcome supply on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE place on any coin!