Opinions expressed by Entrepreneur contributors are their very own.

How can we be speaking about beginning a enterprise and already discussing the right way to exit? It might appear counterintuitive, however having a well-defined exit strategy from the start is likely one of the most important steps an entrepreneur can take.

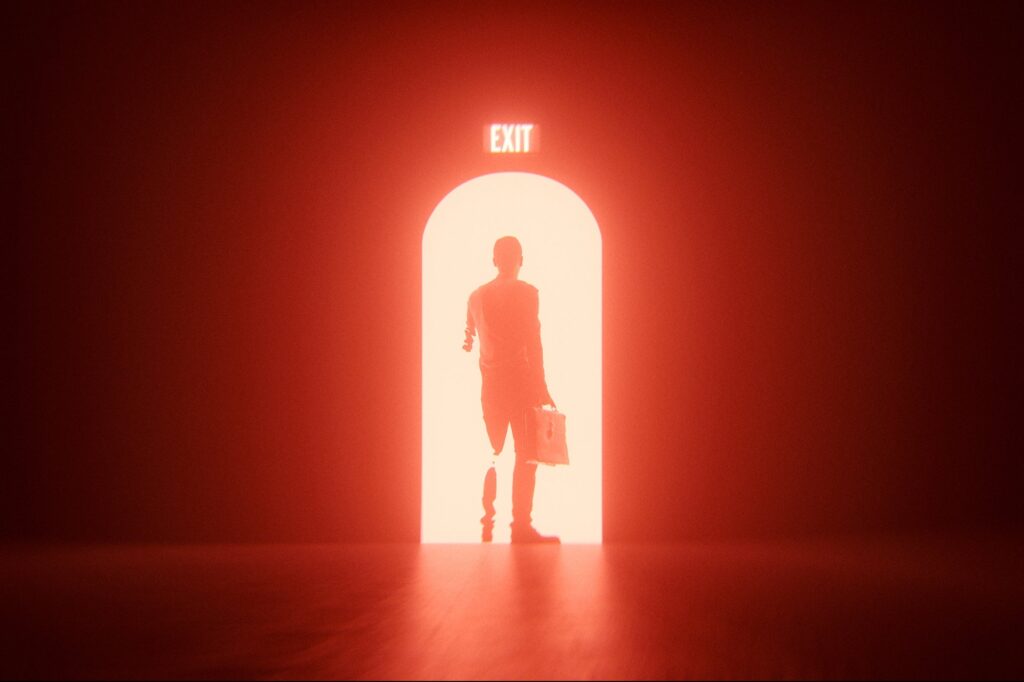

Once you enter a constructing, one of many first security measures is realizing the place the exits are. The identical logic applies to enterprise — your entry technique could also be thrilling, however your exit technique is simply as important. Actually, in lots of locations, hearth departments will not approve a constructing allow except the exits are clearly marked. If we require readability on exits for security in a bodily house, why would not we require the identical for our companies?

Tony Robbins, a famend entrepreneur and strategist, usually emphasizes that “success with out achievement is the final word failure.” The identical precept applies to enterprise — development and not using a plan for a smooth transition can go away years of effort wasted. An exit technique offers entrepreneurs the facility to dictate how they go away their enterprise, as a substitute of being pressured out by circumstances.

Associated: 4 Questions All Business Owners Need to Answer to Have a Successful Exit Plan

1. Perceive why an exit technique issues

An exit technique is not nearly leaving — it is about maximizing worth. The best plan permits you to:

-

Promote at peak worth: A enterprise with a transparent transition plan is extra engaging to traders or patrons.

-

Defend your monetary future: Guaranteeing you will have the monetary stability to transition easily.

-

Keep enterprise continuity: A structured exit helps staff, purchasers and stakeholders navigate the change.

-

Keep away from rushed choices: With out a plan, entrepreneurs could also be pressured to promote underneath unfavorable situations.

At Coworking Good, I structured my enterprise with an exit technique in thoughts from the beginning. This meant automating operations, constructing a strong leadership team and guaranteeing a number of income streams. The consequence? A enterprise that runs effectively, whether or not I’m concerned each day or not, making it a pretty asset for potential patrons.

2. Establish the correct exit technique for you

Totally different entrepreneurs have totally different targets, and the correct exit plan is dependent upon your imaginative and prescient. Listed below are the most typical methods:

-

Promoting to an investor or competitor: If your small business has robust development potential, traders or opponents could also be prepared to amass it.

-

Mergers and acquisitions (M&A): Partnering with another company can present a structured exit whereas guaranteeing continuity.

-

Passing it to household or staff: Transitioning management to a trusted successor can hold the enterprise legacy intact.

-

Going public (IPO): Whereas uncommon, taking a company public provides excessive monetary returns however comes with regulatory complexities.

-

Gradual step-back (proprietor buyout): Some entrepreneurs favor a phased transition, promoting shares over time whereas remaining concerned.

Associated: 4 Go-To Moves to Help Start Your Exit Strategy Now

3. Construct your small business to be exit-ready

What you are promoting ought to serve you — not the opposite method round. Meaning creating an organization that capabilities independently from you. If your small business relies upon totally in your each day involvement, it is not really worthwhile to potential patrons.

-

Doc all processes: A enterprise reliant on undocumented data is not scalable.

-

Develop robust management: Jim Collins, in Good to Nice, stresses the significance of placing the correct folks in the correct seats. Should you construct a team that can operate without you, your small business might be much more engaging to traders.

-

Diversify income streams: A predictable and steady money circulate makes an organization far simpler to promote.

-

Strengthen monetary well being: Clear monetary information and constant profitability are essential. Analysis from Harvard Business Review exhibits that firms with standardized monetary practices obtain greater valuations.

4. Decide your monetary freedom quantity

Enterprise homeowners haven’t got conventional retirement plans. Meaning you could outline what monetary freedom seems like for you. Is it $5 million? $10 million? Extra? The quantity varies for every entrepreneur, however realizing your goal helps form your choices right now.

Most profitable entrepreneurs attain this monetary objective by means of:

-

Constant, well-managed money withdrawals (pró-labore), guaranteeing monetary stability over time.

-

Forming leaders and successors who will proceed working the enterprise when you accumulate returns.

-

Promoting the enterprise outright at a excessive valuation when the time is correct.

The secret is guaranteeing that once you attain your monetary freedom quantity, you’ll be able to select whether or not to proceed working — not as a result of it’s a must to, however since you need to.

5. Execute your exit technique with confidence

A well-structured exit does not occur in a single day. It requires a transparent, strategic method:

-

Set a transparent timeline: Outline when and the way you propose to transition.

-

Put together stakeholders: Staff, companions and traders shouldn’t be blindsided.

-

Optimize for tax effectivity: Work with monetary and authorized specialists to keep away from pointless tax burdens.

-

Negotiate correctly: A strong exit plan offers you leverage, guaranteeing the most effective phrases potential.

Associated: 4 Key Strategies for a Successful Exit

At Coworking Good, I made it some extent to construction offers the place I nonetheless had the choice to stay concerned in an advisory function post-exit. This allowed for a easy transition and ensured the corporate continued thriving.

Probably the most profitable entrepreneurs take into consideration the endgame from the very starting. As Peter Drucker famously stated, “Should you’re not primary or quantity two in what you are doing, it’s best to rethink your technique.” Successful in enterprise is not nearly surviving day-to-day — it is about having a transparent long-term imaginative and prescient that ensures financial success and a satisfying life.

I’ve seen too many entrepreneurs work laborious for many years, solely to seek out themselves nonetheless grinding in previous age as a result of they by no means set an exit plan. That is not freedom. True entrepreneurial success means constructing one thing worthwhile, then stepping again by yourself phrases.

What you are promoting ought to serve you, not the opposite method round. Work laborious, but in addition work sensible. Outline the place you are going, construction your exit technique right now, and when the time comes, you may be in charge of your legacy and monetary future. Founders who plan their exit from the start are considerably extra prone to safe a worthwhile and easy transition. Do not go away your future to likelihood — take management now, and construct a enterprise that works for you.