Traders craving a boring backdrop for Nvidia earnings this week can simply neglect it. The principle supply of the hoopla is the emergent Chinese language startup DeepSeek, which rattled the Membership inventory late final month with claims of extra environment friendly AI fashions. Nvidia’s next-generation Blackwell chip platform has additionally confronted rollout constraints. In different phrases, CEO Jensen Huang has a lot to speak about Wednesday night when the dominant maker of synthetic intelligence chips delivers fiscal fourth-quarter outcomes. For the November to January interval, Wall Road expects Nvidia to report earnings per share of 84 cents on revenues of $38.05 billion, implying year-over-year development of 61.5% and 72%, respectively. Nvidia can be anticipated for the primary time to offer a take a look at fiscal 2026 numbers. The consensus estimate for income within the firm’s fiscal first quarter, which ends in April, is roughly $42 billion. The preliminary market panic over DeepSeek has calmed, and Nvidia shares have erased most of their 18% tumble within the first week of the fallout, buying and selling at roughly $135 every Monday. The inventory fell from $142.62 on Jan. 24 earlier than closing as little as $116.66 on Feb. 3. Nonetheless, the general tenor of the AI dialog feels totally different, and questions circling Monday about Microsoft’s data-center lease plans underscore the uneasiness that exists amongst some AI buyers. In about 48 hours, although, Wall Road analysts will lastly get an opportunity to ask Huang, broadly thought to be an AI visionary, questions on DeepSeek’s implications for Nvidia’s enterprise. The explanation Nvidia shares plunged following DeepSeek’s arrival was a priority that its claims of environment friendly, lower-cost AI fashions — although in all probability not as low price as initially assumed — will sharply cut back the variety of superior chips wanted sooner or later to coach and run AI purposes on a day-to-day foundation, a course of often known as inference . The counterargument was AI fashions which can be cheaper to develop and deploy ought to make AI extra accessible and enhance adoption by corporations and customers alike — and, in the end, require considerably extra computing energy in mixture. NVDA 1Y mountain Nvidia’s inventory efficiency over the previous 12 months. Huang’s solely public feedback on DeepSeek got here to gentle final week in a taped dialog with DDN chief govt Alex Bouzari that aired throughout a digital occasion held by that data-storage firm. The feedback might foretell the arguments Huang makes on Wednesday’s name, so it is value taking a more in-depth take a look at them. Within the DDN interview, Huang steered that the inventory market response to DeepSeek was based mostly on an incomplete understanding of AI mannequin coaching, a compute-heavy course of wherein fashions are fed huge quantities of knowledge — equivalent to textual content, pictures and video — to be taught patterns inside the dataset . The fashions depend on these discovered patterns to generate outputs throughout inference. Huang stated that many buyers failed to acknowledge that coaching is a multistep course of, with an preliminary “pretraining” section adopted by “post-training,” the place the mannequin is fine-tuned and optimized earlier than being deployed into inference. Submit-training is “the place you be taught to resolve issues,” Huang stated. “There’s a complete bunch of various studying paradigms which can be related to post-training, and on this paradigm, the know-how has developed tremendously within the final 5 years and the computing wants [are] intensive,” he added. With a few of DeepSeek’s improvements, “individuals thought, ‘Oh my gosh, pretraining is so much much less.’ They forgot that post-training is admittedly fairly intense,” he stated. Huang additionally stated that DeepSeek’s top-end mannequin, often known as R1, is taken into account a reasoning mannequin, which breaks down person prompts into smaller items and spends extra time “pondering” earlier than producing a solution. Generally, most of these fashions are able to dealing with extra superior duties than the one which powered OpenAI’s ChatGPT when it first launched in late 2022 and sparked the AI growth. OpenAI, for its half, launched its reasoning mannequin late final yr and launched a brand new model in January. “Reasoning is a reasonably compute-intensive half,” Huang stated. “And so, I feel the market responded to R1 as an, ‘Oh my gosh, AI is completed. … We need not do any computing anymore.’ It is precisely the alternative.” Nvidia’s launch of Blackwell additionally will command appreciable deal with Wednesday night — and so far as the short-term impression on the financials goes, it holds much more weight than DeepSeek. Baked into Nvidia’s fiscal This autumn income steerage of roughly $37.5 billion, which is a bit decrease than the present consensus, was at the very least “a number of billion {dollars}” of Blackwell gross sales. Succeeding Nvidia’s blockbuster Hopper lineup, Blackwell entered full manufacturing within the fall — and by early January, Huang stated on the CES commerce present in Las Vegas that “each single cloud service supplier” had Blackwell-based techniques “up and operating.” Nevertheless, the method of producing and putting in the top-of-the-line Blackwell product — a full server rack model often known as the GB200 NVL72 — has confronted some challenges, analysts say. For instance, server maker Hewlett Packard Enterprise introduced its first GB200 cargo lower than two weeks in the past . However that does not imply Nvidia’s quarterly numbers, or steerage for its fiscal 2026 first quarter ending in April, are fully susceptible to developing quick. In a word final week, analysts at KeyBanc Capital Markets stated that regardless of decrease GB200 rack shipments, they anticipate a special, comparatively less complicated Blackwell product known as the HGX B200, plus shipments of H20 chips to Chinese language prospects, to “drive upside.” The truth is, KeyBanc stated DeepSeek’s emergence has helped spark a “surge in demand” for H20s, that are throttled-back variations of Hopper chips supposed to adjust to U.S. commerce restrictions on superior AI chip exports to China. Whereas there’s a rising perception that the U.S. will tighten export controls in response to DeepSeek, within the close to time period, China seems to be a supply of power. The Hopper-to-Blackwell transition “has been just a little bumpier than anticipated,” Melius Analysis analysts wrote to purchasers Monday. “Nevertheless, gross sales prospects nonetheless appear nice by F2Q26 – and there may be already lots of chatter in regards to the Blackwell Extremely (GB300), prone to be unveiled at its GPU Know-how Convention (GTC) in March and transport by [calendar year-end].” GTC is Nvidia’s annual developer convention and product present and inform. Put all of it collectively, and Melius steered that Nvidia’s steerage for the April quarter might not exceed consensus by as a lot as buyers have come to anticipate in recent times. Nevertheless it will not be lengthy earlier than “a extremely large bump” in income due to Blackwell materializes, analysts argued. Backside line Nvidia buyers have their palms full coming into Wednesday night. “The quarter feels poorly arrange,” as Jim Cramer wrote in his Sunday column . To make sure, the DeepSeek saga in latest weeks examined Jim’s resolve, one thing he acknowledged throughout our Month-to-month Assembly final week . Nevertheless, he stated his religion in Huang’s stewardship of the corporate stays sturdy, and that is why he designated Nvidia an “personal it, do not commerce it” inventory to start with. The excellent news is that with so many questions surrounding Nvidia’s earnings report, buyers are lastly going to get solutions instantly from Huang and revered finance chief Colette Kress. We have been ready for that. (Jim Cramer’s Charitable Belief is lengthy NVDA, MSFT. See right here for a full listing of the shares.) As a subscriber to the CNBC Investing Membership with Jim Cramer, you’ll obtain a commerce alert earlier than Jim makes a commerce. Jim waits 45 minutes after sending a commerce alert earlier than shopping for or promoting a inventory in his charitable belief’s portfolio. If Jim has talked a couple of inventory on CNBC TV, he waits 72 hours after issuing the commerce alert earlier than executing the commerce. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

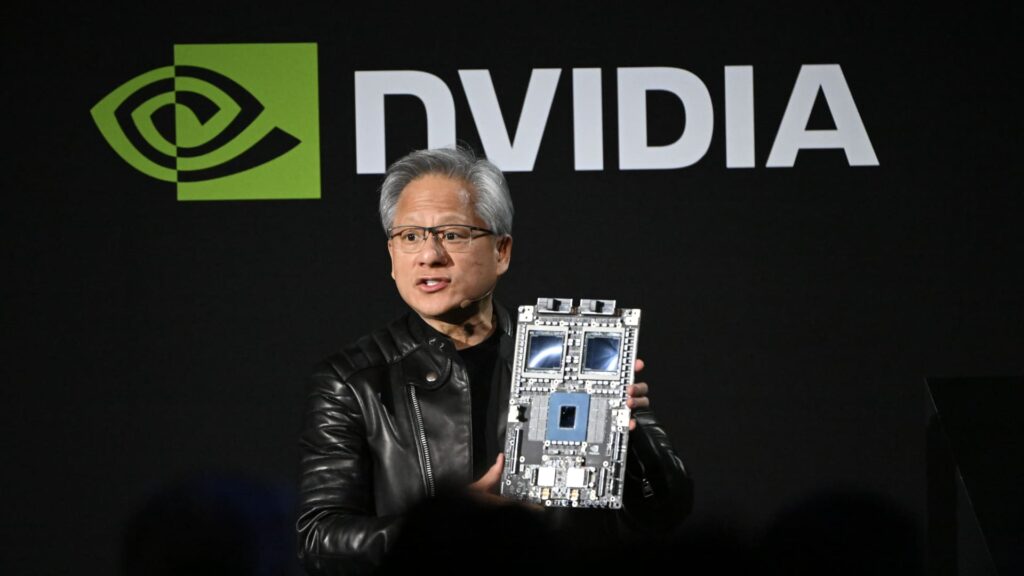

Jensen Huang, co-founder and CEO of Nvidia Corp., holds up the corporate’s AI accelerator chips for knowledge facilities as he speaks throughout the Nvidia AI Summit Japan in Tokyo on Nov. 13, 2024.

Akio Kon | Bloomberg | Getty Photos

Traders craving a boring backdrop for Nvidia earnings this week can simply neglect it.