Individuals typically face the difficulty of by chance sending cash to the improper account. If it’s inside the similar financial institution, resolving the issue is simple and simple.

In such a case, your financial institution is likely to be in a greater place that can assist you out. However, if this similar difficulty occurs when you’re paying to a different checking account. Like defective funds by means of NEFT or RTGS, how do you remedy the issue?

That’s slightly bit difficult, however you recognize? It’s potential to reverse the transaction. If in case you have made the identical mistake, right here’s what it is advisable do, to be able to get your a reimbursement.

Let’s start with NEFT and RTGS. What are their phrases and situations?

NEFT (Nationwide Digital Fund Switch)

It’s an electronic fund transfer system dealt with by the Reserve Financial institution of India. A lot of the banks have the licence to hold out the transaction in favour of the reserve financial institution.

An individual can provoke a fund switch from any financial institution. It may be used for private in addition to enterprise transactions.

There isn’t any restrict to the quantity you possibly can switch by means of NEFT. It may be as little as ₹100, and there’s no most restrict to the fund switch.

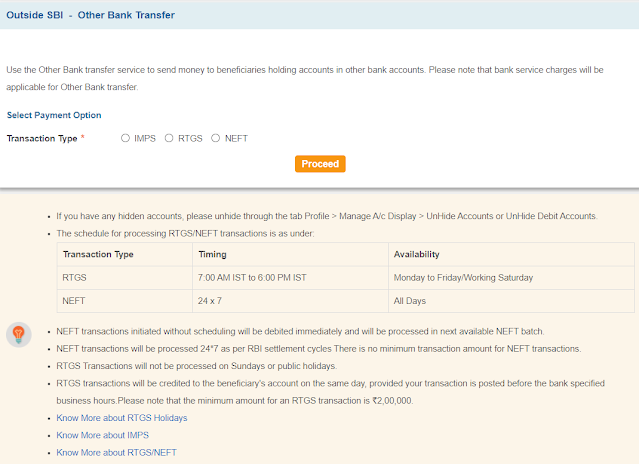

The time schedule for NEFT is notified by RBI within the round dated August 30, 2019, which states that NEFT shall be obtainable 24/7.

The transaction shall be settled 48 instances a day, each half an hour, all through the day.

And the beneficiary will get the funds inside 2 hours of a transaction initiated by the sender.

It may be accomplished by presenting a cheque to your financial institution, which they use to cost nominal charges, or you are able to do it straight by means of your web banking, which is, ofcourse,e freed from cost.

RTGS (Actual Time Gross Settlement)

In RTGS transactions, the settlement of funds happens immediately on a one-to-one transaction foundation. The quantity of transaction could be ₹ 2 lakhs and above. No most quantity has been capped, which implies an individual can switch funds as per his requirement.

Transaction hours are from 7 AM to six PM on all working days, for fund settlement at RBI. If you happen to switch funds utilizing RTGS after working hours, your transaction shall be settled on the following working day.

Click on here for the vacation record of RTGS.

The service cost for RTGS has been waived by RBI since July 2019. RBI permits banks to get well nominal service prices, which mustn’t transcend the restrict given beneath

- For quantities between ₹ 2 lakhs to ₹ 5 lakhs, the service cost is capped most at ₹ 24.50 excluding of tax if any.

- For quantities above ₹ 5 lakhs, the service cost is capped most at ₹ 49.50 excluding tax if any.

Coming again to the primary difficulty, what if in case you have despatched cash to the improper account?

Right here’s How To Reverse The Transaction.

That’s a reasonably difficult query. As you see within the RBI round, it’s clearly talked about that the transaction is closing and irrevocable as soon as it’s settled.

There are specific issues which can be price figuring out relating to NEFT and RTGS.

Not like a traditional transaction, whilst you pay, the whole lot needs to be tallied to be able to make your transaction profitable. What it means is that the title of the beneficiary, and the account quantity must be matched, and solely then will your transaction get by means of.

However right here, within the case of RTGS and NEFT, solely the account quantity does matter. Whether or not the beneficiary names are given correctly or not, if the account quantity is okay, then the transaction will undergo.

So, you’ve got to be very cautious whereas initiating this type of transaction. As soon as it’s transferred to the improper account, it could take days to get your fund refunded.

It’s advisable to double-check all the small print earlier than hitting the ultimate button.

Right here’s what you are able to do!

Search recommendation out of your financial institution to see if they’ll intervene and aid you get your refund. The financial institution could take a couple of days, as it might take approval from the account holder to reverse the fund.

The account holder has full rights to reject the refund transaction because it was not his fault. He may say he’ll refund after a while if he isn’t ready to method his banker or if he doesn’t have a web based banking service.

You may write an software to the beneficiary financial institution by means of your banker, to get related to the particular person to whom you’ve wrongly credited the fund and settle between you and the opposite celebration.

Nevertheless, your banker must indemnify your credential, in order that, if any untoward issues materialized, your financial institution would take the autumn.

It’s fairly a fragile scenario to deal with, and it could waste your beneficial time too. So, it’s at all times advisable to double-check earlier than confirming your transaction.

Particulars which can be required for RTGS/NEFT.

- You have to have an account on the financial institution. A chequebook or Web banking is a should. Your cellular quantity and your account needs to be absolutely KYC compliant.

- Beneficiary particulars needs to be exact and correct.

- Title of the beneficiary

- IFSC (Indian Monetary System Code) for the beneficiary financial institution. It’s an 11-digit code.

- Account variety of the beneficiary.

- Handle particulars of the beneficiary.

- Title of the financial institution and department

The right way to Enquire about non-credit to the beneficiary account?

Usually, if the transaction fails because of some circumstances, the fund is reversed inside 2 hours of the transaction. If not occur, you could both method your banker to see if there’s any difficulty with the transaction.

Your banker may be capable to resolve the difficulty. Nevertheless, RBI has additionally supplied a buyer contact centre, the place you possibly can mail your difficulty on to their e mail or publish mail to them.

For extra particulars, please go to here.

Also, read on How to put a stop to your lost cheque!

The place can you discover UTR quantity?

UTR or Distinctive Transaction Reference Quantity, is a 22 alpha-numeric code generated for every transaction.

It’s the distinctive id of every transaction.

You might obtain it in your registered cellular quantity as quickly because the transaction is accomplished. It is usually present in your assertion of account.

So, NEFT and RTGS are fairly useful instruments for many who closely depend on totally different banks for transactions, both for private functions or for enterprise. General, RBI has supplied an infinite quantity of service to the nation by means of this product.

Earlier, when there was no digital fund switch system, a single transaction would take days to finish, now it’s at our fingertips. It’s as much as you the way you get essentially the most out of it.