Wall Road completed final week with large back-to-back declines, transferring the S & P 500 away from Wednesday’s record-high shut. Chip big Nvidia had a tough week forward of this week’s earnings. The S & P 500 flipped unfavorable for all of final week, down 1.7%, after Friday buying and selling prolonged the weak point of the prior session. The Dow was the worst performer for the week, falling 2.5%, as Dow shares Walmart and UnitedHealth weighed closely on the 30-stock common. Walmart dropped one other 2.5% on Friday after Thursday’s 6.5% decline on weak steerage. UnitedHealth sank 7% on Friday after The Wall Road Journal stated the Justice Division is investigating the insurer over Medicare billing practices. The Nasdaq additionally closed decrease for the week, off 2.5%, as a few of the current high-flyers corresponding to Palantir got here again in the direction of Earth. The know-how and protection inventory sank 15% for the week on information of CEO Alex Karp’s new inventory sale plans and reviews of federal army finances cuts. Friday’s selloff pushed Nvidia down greater than 3% for the week after taking two big leaps ahead within the two prior weeks in attempting to get better its DeepSeek losses. In a busy week of tradin g, the Membership exited two positions: Constellation Manufacturers on Tuesday and Finest Purchase on Thursday. We took benefit of a bump Constellation Manufacturers on Warren Buffett’s Berkshire Hathaway disclosing a small stake on the finish of 2024 to promote our remaining shares of the struggling Corona and Modelo brewer. Too many issues have been stacking up in opposition to Constellation from a beer trade slowdown to ongoing troubles with wine and spirits. Potential tariffs on imports from Mexico added one other wrinkle. As for Finest Purchase, we threw within the towel on this one due to our low conviction heading into the electronics retailer’s March 4 earnings report and since we did not need to take the prospect of giving again income. Our latest title, Texas Roadhouse , was the one Membership earnings report final week. The corporate behind its namesake informal eating chain in addition to Bubba’s 33 and Jaggers reported a robust fourth quarter. Nevertheless, it additionally disclosed weather-related noise round its current-quarter visitors and warned of beef inflation. Because the Membership’s director of portfolio analysis, Jeff Marks, wrote Thursday night: “This short-term headwind creates a long-term alternative,” as indicated by our buy-equivalent 1 ranking. Marks additionally reaffirmed the Membership’s $205-per-shre worth goal, which was proper across the inventory’s all-time excessive from again in November. Shares of Texas Roadhouse fell modestly Friday to roughly $170 every. Effervescent within the background have been considerations about President Donald Trump ‘s ever-evolving tariff threats, which emerged as a priority for Federal Reserve financial policymakers. In keeping with the minutes from January’s assembly , when the Fed held rates of interest regular, central bankers indicated they needed to see extra progress on inflation earlier than slicing charges once more. The Fed reduce charges thrice final 12 months and projected two extra cuts this 12 months. The market is placing the best odds on only one reduce in 2025. Economic system The large financial report of the week arrives Friday at 8:30 a.m. ET. The private consumption expenditures worth (PCE) index is the Fed’s most well-liked inflation gauge, regardless that the buyer worth index (CPI) usually garners extra public consideration. The PCE index takes under consideration a bigger scope of spending than the CPI and is seen as higher at reflecting how shoppers regulate their spending in response to cost modifications. Headline PCE for January is predicted to indicate a 0.3% month-over-month rise and a 2.5% annual enhance, in response to FactSet. Core PCE, which strips out the influence of risky meals and vitality costs, is projected to be up 0.3% from December and a couple of.6% yearly, per FactSet. The CPI for January got here in hotter than anticipated earlier this month. Relying on what January’s PCE index has in retailer, we might see a change in Fed charge reduce projections. Along with inflation, the opposite facet of the Fed’s mandate is employment. Whereas the labor market has remained resilient, economists are ready to see whether or not the federal authorities’s mass layoffs will begin exhibiting up in jobs knowledge. Preliminary jobless claims for final week will launched at 8:30 a.m. ET Thursday. Within the week ended Feb. 15, seasonally adjusted jobless claims totaled 219,000. Earnings Coterra Power kicks off our busier week of earnings on Monday night time, adopted by a convention name to debate its fourth-quarter numbers and steerage on Tuesday morning. Shares of Coterra are off to a robust begin to the 12 months, 10.2% 12 months so far, benefitting from a pointy rise in pure gasoline costs . Whereas the corporate can’t management commodity costs, we’ll be listening for commentary on how administration is allocating its manufacturing sources between oil and pure gasoline. Coterra’s capital expenditures — each within the October-to-December interval and in its 2025 steerage — might be vital, too. We at all times need to see Coterra do extra with much less: Enhance manufacturing greater than it is rising capital expenditure (capex) spending. The present consensus is for fourth-quarter income of $1.4 billion and earnings per share (EPS) of 43 cents, in response to market knowledge supplier LSEG. Residence Depot is slated to report Tuesday morning, and we’ll be seeking to see whether or not its ends in the fourth quarter ended Jan. 31 benefited from hurricane rebuilding efforts — an unlucky tailwind for the enterprise, however a tailwind nonetheless. The identical goes for wildfire rebuilding in Los Angeles, which is more likely to present up in future quarters and assist help the enterprise till we see a extra significant restoration in housing market exercise. Analysts anticipate Residence Depot to have earned $3 per share on income of $39.14 billion within the fourth quarter, in response to LSEG. Identical-store gross sales — usually known as comps — is a crucial metric for all retailers. As of Friday, the Wall Road consensus requires Residence Depot to report a 1.5% decline in fourth-quarter comps, in response to FactSet, which might be the ninth unfavorable quarter in a row. Nevertheless, in current weeks, we have seen some analysts revise their projections to name for optimistic comps. Time will inform. We’ll additionally get Residence Depot’s full-year steerage, and the present FactSet consensus is for 1.6% same-store gross sales progress within the 12 months ending in January 2026. On Wednesday morning, it is holiday-quarter outcomes from TJX Firms , the off-price retailer behind the T.J. Maxx, Marshalls and HomeGoods chains. As of Friday, Wall Road tasks TJX will report gross sales of $16.19 billion and EPS of $1.16, in response to LSEG. Identical-store gross sales progress is predicted to be 3%, per FactSet. On the commentary facet, we’ll be listening for updates on the shopping for and stock atmosphere; in November, CEO Ernie Herrman touted an “excellent availability of products throughout a variety of manufacturers.” On the time, Herrman additionally defined how TJX’s mannequin of shopping for stock from different retailers and value-focused ethos offers the corporate flexibility to navigate increased tariffs on imports from China and presumably even be a relative winner . Nonetheless, with Trump’s further 10% tariff on Chinese language imports now in impact, we suspect this might be a subject of dialog on the earnings name as soon as once more. All of it builds as much as Wednesday night time once we’ll hear from each Salesforce and Nvidia after the shut. Agentforce ought to dominate the dialog round Salesforce , which is predicted to report companywide income of $10.04 billion and earnings per share of $2.61 for the three months led to January, in response to LSEG. Agentforce is the corporate’s new suite of software program instruments that lets clients construct and deploy so-called AI brokers, which might full numerous duties with out human intervention. The corporate inked roughly 200 offers for Agentforce final quarter because it was solely out there for a couple of week. In an interview with Bloomberg final month, CEO Marc Benioff stated Salesforce will see “hundreds” of Agentforce offers within the January quarter. That pipeline ought to present up in Salesforce’s remaining efficiency obligation, a monetary metric that represents the entire worth of contracted income. It stood at $53.1 billion, up 10% 12 months over 12 months, on the finish of October. Traders will lastly get to listen to Nvidia CEO Jensen Huang take questions from analysts about DeepSeek, the Chinese language startup that shook up the AI race final month with its extra environment friendly massive language fashions, sparking considerations that much less AI computing energy — i.e., fewer Nvidia chips — might be wanted within the years forward than beforehand thought. Nvidia shares have recovered a big chunk of their DeepSeek-related plunge after its greatest clients — the likes of Amazon , Microsoft and Meta Platforms — stated they nonetheless plan to spend aggressively on AI this 12 months. Nonetheless, we look ahead to listening to Huang communicate at size in regards to the implications of DeepSeek for Nvidia’s enterprise and AI adoption extra typically. The opposite large subject would be the rollout of Nvidia’s next-generation Blackwell chip platform. There’s been quite a lot of discuss challenges with the complete server rack model, often known as the GB200 NVL72 , given the manufacturing and set up complexities. Whereas shipments of the GB200 NVL have been doubtless restricted within the quarter, different Blackwell configurations, together with gross sales of prior era Hopper chips, should drive upside to expectations. As of Friday, analysts mission Nvidia will report earnings per share of 84 cents on revenues of $38.05 billion, in response to LSEG. Week forward Monday, Feb. 24 Earlier than the bell earnings: Domino’s Pizza (DPZ), Owens Corning (OC), Westlake Chemical (WLK) After the shut: Coterra Power (CTRA) , SBA Communications (SBAC), Diamondback Power (FANG), Hims & Hers (HIMS), Public Storage (PSA), Zoom (ZM), Realty Revenue (O), Cleveland-Cliffs (CLF), Topgolf Callaway (MODG) Tuesday, Feb. 25 9 a.m. ET: S & P/Case-Shiller Residence Worth Index 10 a.m. ET: The Convention Board’s Shopper Confidence Survey Earlier than the bell: Residence Depot (HD) , Henry Schein (HSIC), Keurig Dr. Pepper (KDP), American Tower (AMT), Sempra (SRE), Planet Health (PLNT), Krispy Kreme (DNUT), Kontoor Manufacturers (KTB), Elanco Animal Well being (ELAN), LGI Houses (LGIH) After the bell: First Photo voltaic (FSLR), Intuit (INTU), Workday (WDAY), Axon Enterprise (AXON), Caesars Leisure (CZR), AMC Leisure (AMC), Cava Group (CAVA), Coupang (GPNG) Wednesday, Feb. 26 10 a.m. ET: Census Bureau’s New Residence Gross sales Report Earlier than the bell: TJX Firms (TJX) , NRG Power (NRG), Lowe’s Firms (LOW), Further Area Storage (EXR), Verisk Analytics (VRSK), Advance Auto Elements (AAP), Anheuser-Busch InBev (BUD), Bloomin’ Manufacturers (BLMN), Dole (DOLE) After the shut: Salesforce (CRM) , Nvidia (NVDA) , Snowflake (SNOW) Agilent Applied sciences (A), Paramount World (PARA), Salesforce (CRM), eBay (EBAY), Synopsys (SNPS), Teladoc Well being (TDOC), City Outfitters (URBN) Thursday, Feb. 27 8:30 a.m. ET: Preliminary Jobless Claims 8:30 a.m. ET: Gross Home Product, fourth quarter and full 12 months 2024 (second estimate) 10 a.m. ET: Nationwide Affiliation of Realtor’s Pending Residence Gross sales Index 3:15 p.m. ET: GE Healthcare presents Citi MedTech and Life Sciences Entry Day Earlier than the bell: J.M. Smucker (SJM), FirstEnergy (FE), Norwegian Cruise Line (NCLH), Teleflex (TFX), Warner Bros. Discovery (WBD), APA Corp (APA), Common Well being Providers (UHS), Vistra (VST), Penn Leisure (PENN), Hormel Meals (HRL), Beacon Roofing Provide (BECN), Life Time Group (LTH), Six Flags Leisure (FUN), Papa John’s (PZZA) After the bell: Dell Applied sciences (DELL), Edison Worldwide (EIX), Solventum (SOLV), Autodesk (ADSK), HP Inc. (HPQ), NetApp (NTAP), Redfin Corp (RDFN), Rocket Firms (RKT), Duolingo (DUOL) Friday, Feb. 28 8:30 a.m. ET: PCE index Earlier than the bell: AES Corp (AES), EOG Sources (EOG), Mosaic (MOS), fuboTV (FUBO), Chart Industries (GTLS), RadNet (RDNT), World Companions (GLP), Amneal Prescribed drugs (AMRX), Owens & Minor (OMI) (See right here for a full record of the shares in Jim Cramer’s Charitable Belief.) As a subscriber to the CNBC Investing Membership with Jim Cramer, you’ll obtain a commerce alert earlier than Jim makes a commerce. Jim waits 45 minutes after sending a commerce alert earlier than shopping for or promoting a inventory in his charitable belief’s portfolio. If Jim has talked a couple of inventory on CNBC TV, he waits 72 hours after issuing the commerce alert earlier than executing the commerce. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

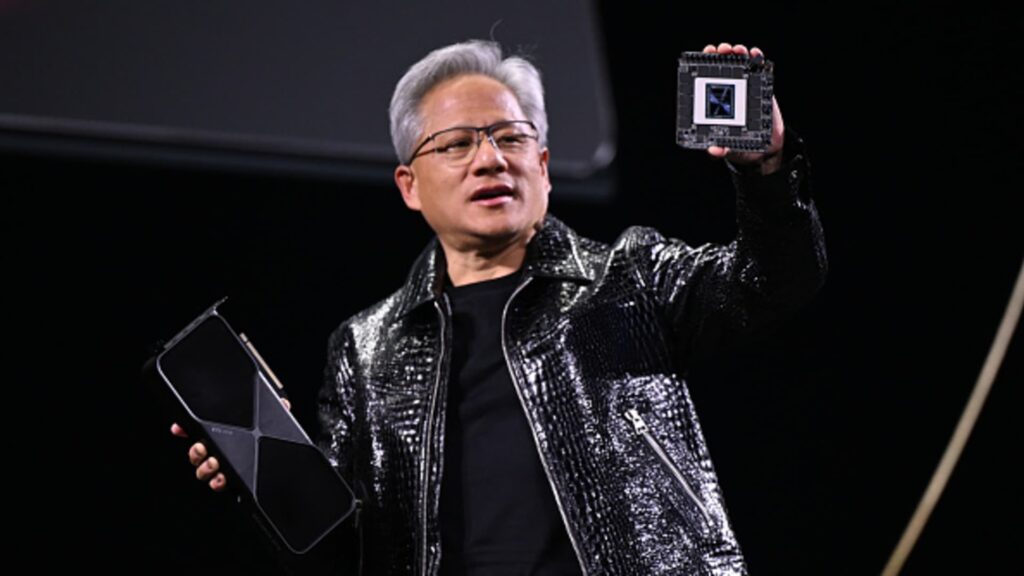

Nvidia CEO Jensen Huang delivers a keynote deal with on the Shopper Electronics Present (CES) 2025, showcasing the corporate’s newest improvements in Las Vegas, Nevada, USA, on January 6, 2025.

Artur Widak | Anadolu | Getty Photographs