Crypto staking is the spine of each Proof-of-Stake (PoS) blockchain. With out it, most crypto networks wouldn’t be capable to safe their major mechanism for safety and transaction validation. That’s how essential it’s.

Staking additionally ensures that validators have a monetary incentive to behave actually, as their staked tokens may be slashed, both partially or absolutely, for participating in malicious conduct or failure to carry out their respective duties.

One other key level is that staking is essential for retaining blockchain ecosystems decentralized. It supplies a structured technique to reward contributors for contributing to a community’s well being and total performance.

This text takes a deep dive into one of the best crypto staking platforms, every reviewed rigorously by their functionalities and quantity of property supported. It additionally goes via the fundamentals of staking and easy methods to stake crypto in a number of methods.

Fast Navigation

What Is DeFi Staking?

Staking is the method of locking up cryptocurrency in a pockets to assist safe and preserve a blockchain community that makes use of a Proof of Stake (PoS) consensus mechanism. In return for committing your tokens, you earn rewards—usually within the type of further cryptocurrency. By staking, you contribute to the community’s safety, validate transactions, and assist create new blocks on the blockchain.

In essence, staking incentivizes sincere conduct. Customers who stake their cash can achieve rewards for supporting the community, whereas malicious or negligent validators threat having their tokens “slashed” (i.e., a portion of their stake is eliminated). This setup encourages energetic participation and maintains the blockchain’s integrity.

Advantages of Crypto Staking

There are a number of benefits to crypto staking, not only for customers but additionally for blockchain networks and DeFi protocols:

- Passive yield technology:

Staking means that you can earn rewards with out promoting cryptocurrency, making a constant passive earnings stream. If reinvested, these rewards can compound, boosting your total returns.

- Greater returns:

Relying on the blockchain and market surroundings, annual proportion yields (APYs) can vary from single digits to over 20%, making them a extra profitable possibility than many standard monetary devices.

- Extra accessibility and community help:

Not like PoW blockchains, staking requires no specialised {hardware} or heavy vitality use as a result of PoS networks solely require comparatively smaller quantities, making it accessible to a broad vary of contributors.

Furthermore, by locking up tokens, you assist validate transactions on the blockchain, defending it towards threats like 51% assaults and sustaining long-term stability. This rewards customers for his or her position in community well being.

- Liquidity choices:

Liquid staking derivatives (Lido’s stETH, Rocket Pool’s rETH, and so on) allow you to entry your staked property in DeFi whereas nonetheless incomes staking rewards, offering flexibility for extra buying and selling or lending actions.

- Restaking:

Some fashionable protocols like EigenLayer assist you to “restake” your already-staked tokens, utilizing them as collateral or deploying them in different staking techniques. This technique can compound yields additional and improve engagement throughout the DeFi ecosystem. However, the largest perk is that restaking permits DeFi tasks to leverage the safety and capital of already established networks.

This will probably be defined additional within the article, however for now, word that restaking is way extra complicated than conventional or liquid staking, requiring extra tasks and technical information to hold out the method.

Finest Crypto Staking Platforms in 2025: Our Prime Picks

Beneath are a number of the finest staking platforms, offering a complete breakdown of their options, supported property, and different essential info.

Jito – Solana’s Largest Liquid Staking Platform

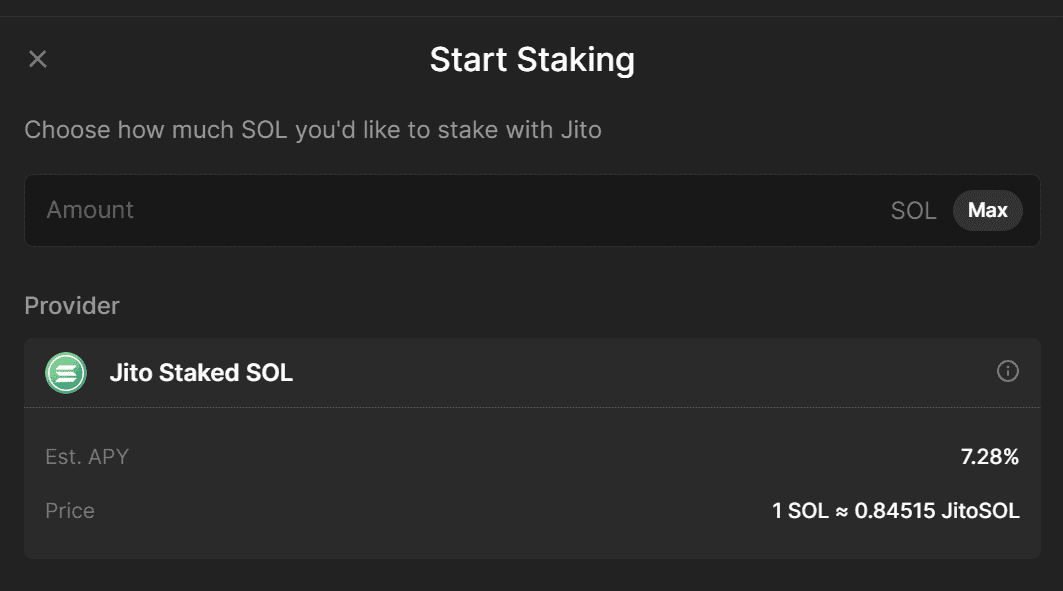

Jito is the largest liquid staking platform on the Solana blockchain. Members stake SOL and obtain JitoSOL in trade, which is a liquid staking token (LST) that can be utilized in different Solana-based dApps. This permits customers to lock their staked tokens however use a tokenized model in different DeFi tasks to generate extra yields.

The mission’s MEV method—usually controversial—has drawn consideration. Some critics argue that MEV exploits merchants by front-running orders or reordering transactions, whereas others see it as a approach to enhance market effectivity and guarantee lenders are repaid.

Jito tackles MEV by implementing an public sale system the place merchants bid on worthwhile transaction sequences. Third-party block engines simulate these bids to establish probably the most worthwhile transaction groupings. The ensuing earnings are funneled again to validators and JitoSOL holders, successfully curbing spam advantages and rising staking rewards.

Key Options of Jito

- Liquid staking with JitoSOL: Customers stake SOL and obtain JitoSOL, representing their staked property. JitoSOL may be deployed throughout DeFi (e.g., lending, buying and selling, or liquidity swimming pools) whereas persevering with to earn staking rewards.

- MEV Integration: Jito captures MEV by optimizing transaction ordering inside blocks, redistributing additional income to JitoSOL holders, and boosting total staking yields.

- Full decentralization: The protocol’s governance token, JTO, grants holders voting rights on delegation methods, treasury administration, and protocol updates, whereas the Jito DAO ensures community-driven oversight.

- Safety and transparency: Jito depends on audited sensible contracts and delegates SOL to established validators throughout the Solana ecosystem. Governance by the Jito DAO additional enhances transparency.

Supported Belongings

Given Jito’s unique integration with the Solana blockchain, it solely helps SOL tokens.

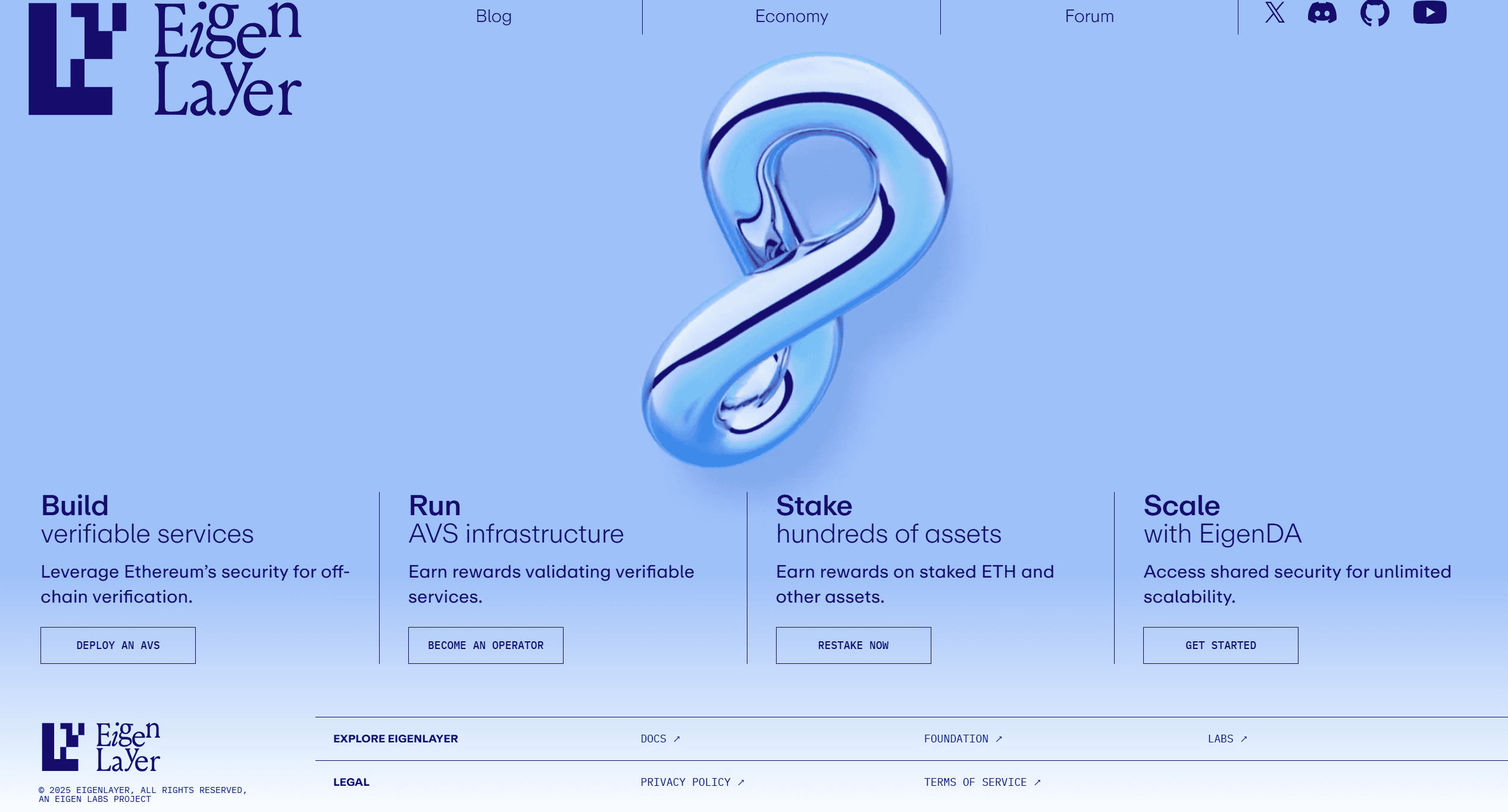

EigenLayer – The Restaking King

EigenLayer is a middleware protocol constructed on Ethereum that pioneered the concept of restaking, that means you may deposit staked ETH (like stETH) into a brand new set of liquidity swimming pools. These staked tokens are then distributed throughout numerous decentralized purposes or AVS (Actively Validated Providers), oracles, Layer 2s, information availability layers, cross-chain bridges, and extra.

By doing so, EigenLayer permits these providers to faucet into Ethereum’s strong safety with out creating their very own separate validator networks.

Key Options of EigenLayer

- Restaking market: In a way, EigenLayer is a type of market the place validators and protocols negotiate pooled safety for a value. Protocols can purchase staked tokens or stETH as an “additional layer” of safety. In the meantime, validators can select which protocols they need to safe, evaluating them for threat and reward. Additionally they management how a lot staked capital is allotted, stopping overexposure to any single protocol.

- Versatile staking choices: Customers can go for solo staking, run their very own nodes, delegate their stake to 3rd events, and even carry out twin staking, requiring each ETH and a local token to be staked. This manner, the protocol welcomes extra superior validators, customers, and builders.

- Programmability: Builders can customise validation guidelines and safety parameters for his or her EigenLayer-based purposes, permitting for extra nuanced safety, together with multi-token quorums tailor-made to particular threat profiles.

- Modular safety: EigenLayer helps a modular method, letting stakers safe particular functionalities or “modules,” similar to decentralized storage, DeFi purposes, or cross-chain bridges. This flexibility tailors safety to every mission’s distinctive necessities.

Supported Belongings

EigenLayer solely helps ETH, any ERC-20 token, and liquid staking tokens similar to Lido’s stETH and Rocketpool’s rETH.

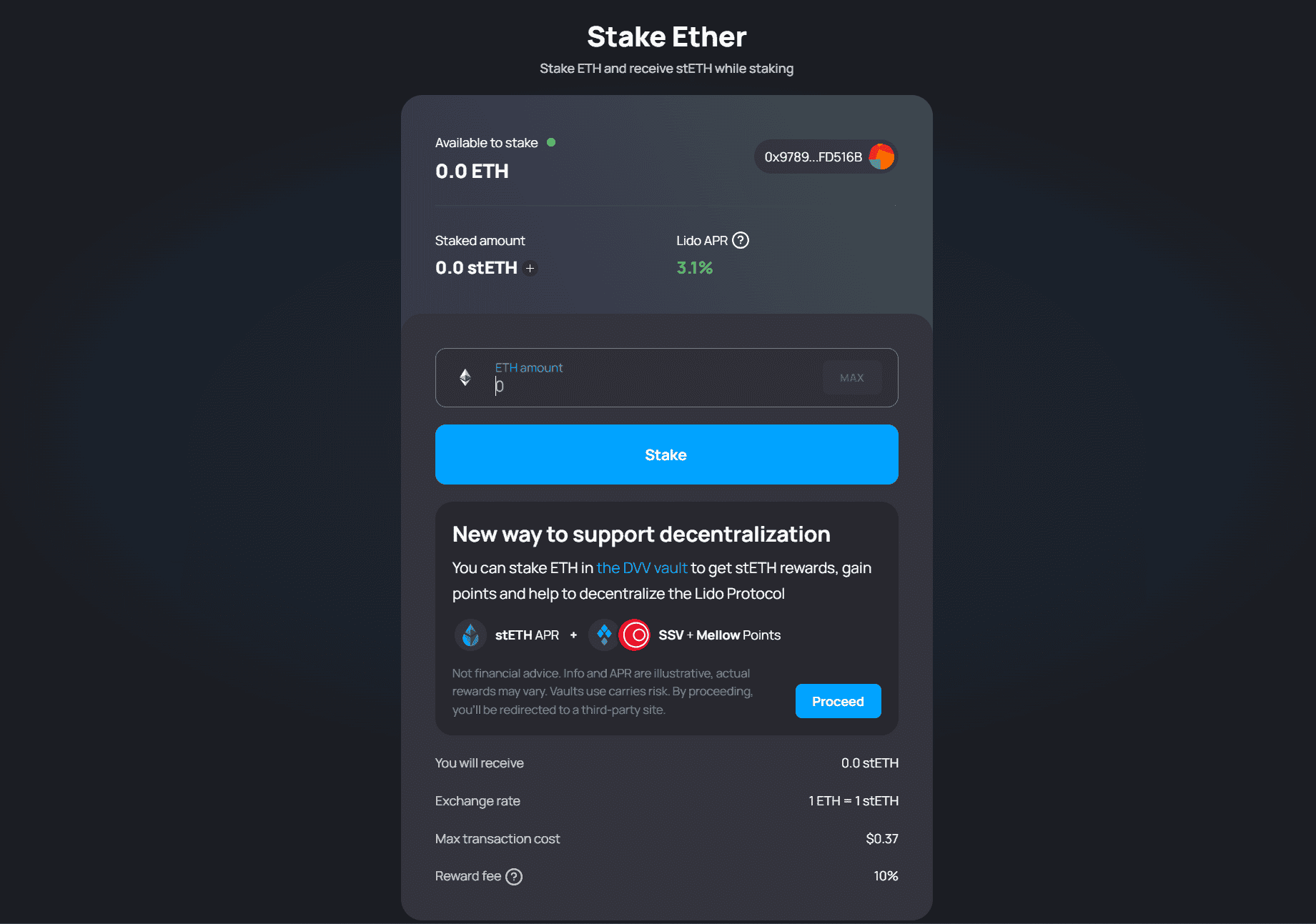

Lido Staking

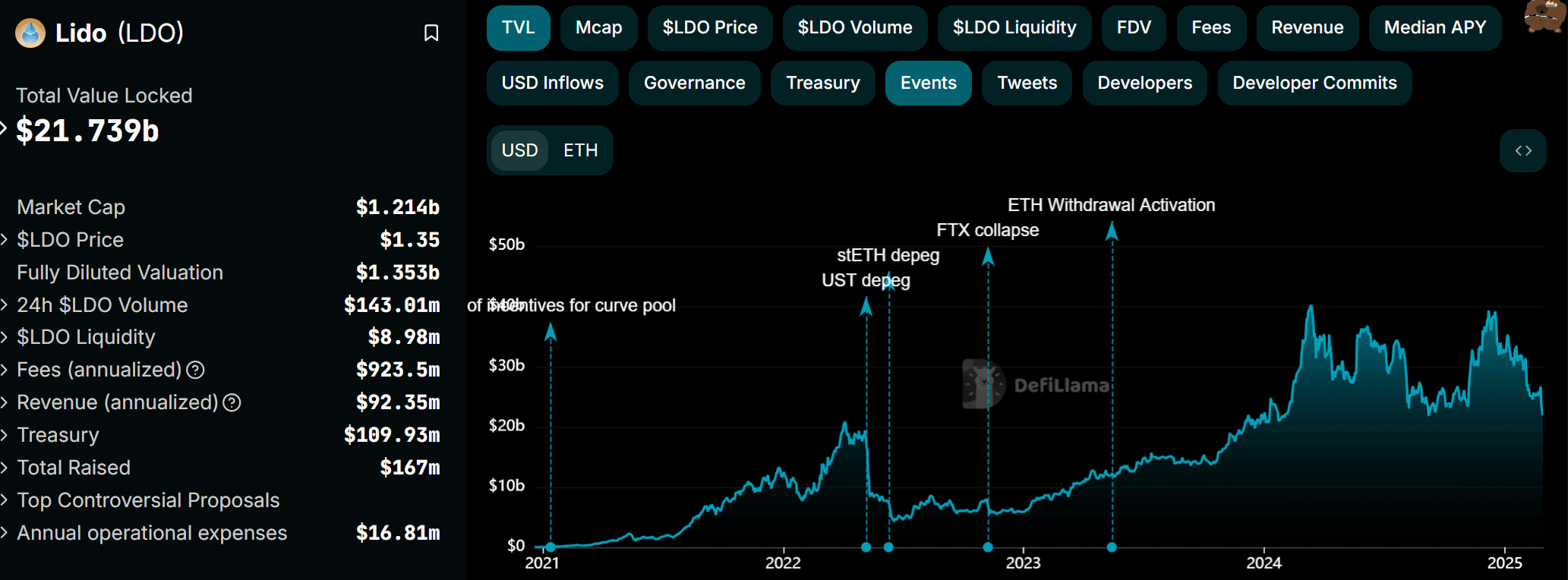

Lido is the biggest decentralized liquid staking platform within the business, reaching a peak of roughly $40B in whole worth locked (TVL) in mid-2024, representing a large share of the overall DeFi TVL.

Lido’s attraction is simple: It permits customers to earn staking rewards on numerous PoS cryptocurrencies with out requiring them to unstake their property. This makes Lido the pioneer of liquid staking: The protocol points a tokenized model of ETH, stETH, which represents the staked property.

Customers can deploy stETH throughout a number of DeFi tasks in Ethereum, permitting them to earn further yield on prime of their staked property.

Key Options of Lido

- Liquid Staking: Whenever you stake with Lido, you obtain a spinoff token, like stETH, on a 1:1 foundation. Furthermore, customers can stake any quantity of crypto, apart from validators, which require the everyday 32 ETH deposit.

- Validator Distribution: Staked tokens are unfold throughout a community {of professional} validators chosen by the Lido DAO, decreasing dangers tied to validator downtime or slashing penalties.

- Open supply and audited: Lido’s sensible contracts are publicly accessible and recurrently audited. Audits may be discovered on GitHub.

- Payment construction: Lido prices a ten% payment on staking rewards, which is shared between node operators and the Lido DAO treasury.

Supported Belongings

Lido helps all kinds of crypto property, together with:

- ETH is probably the most broadly used staking possibility on Lido.

- Polygon (MATIC): Tokenized as stMATIC.

- Kusama (KSM): Tokenized as stKSM.

- Polkadot (DOT): Tokenized as stDOT.

Nonetheless, help for SOL was discontinued as a result of disagreements and neighborhood votes over unsustainable long-term charges on each blockchains.

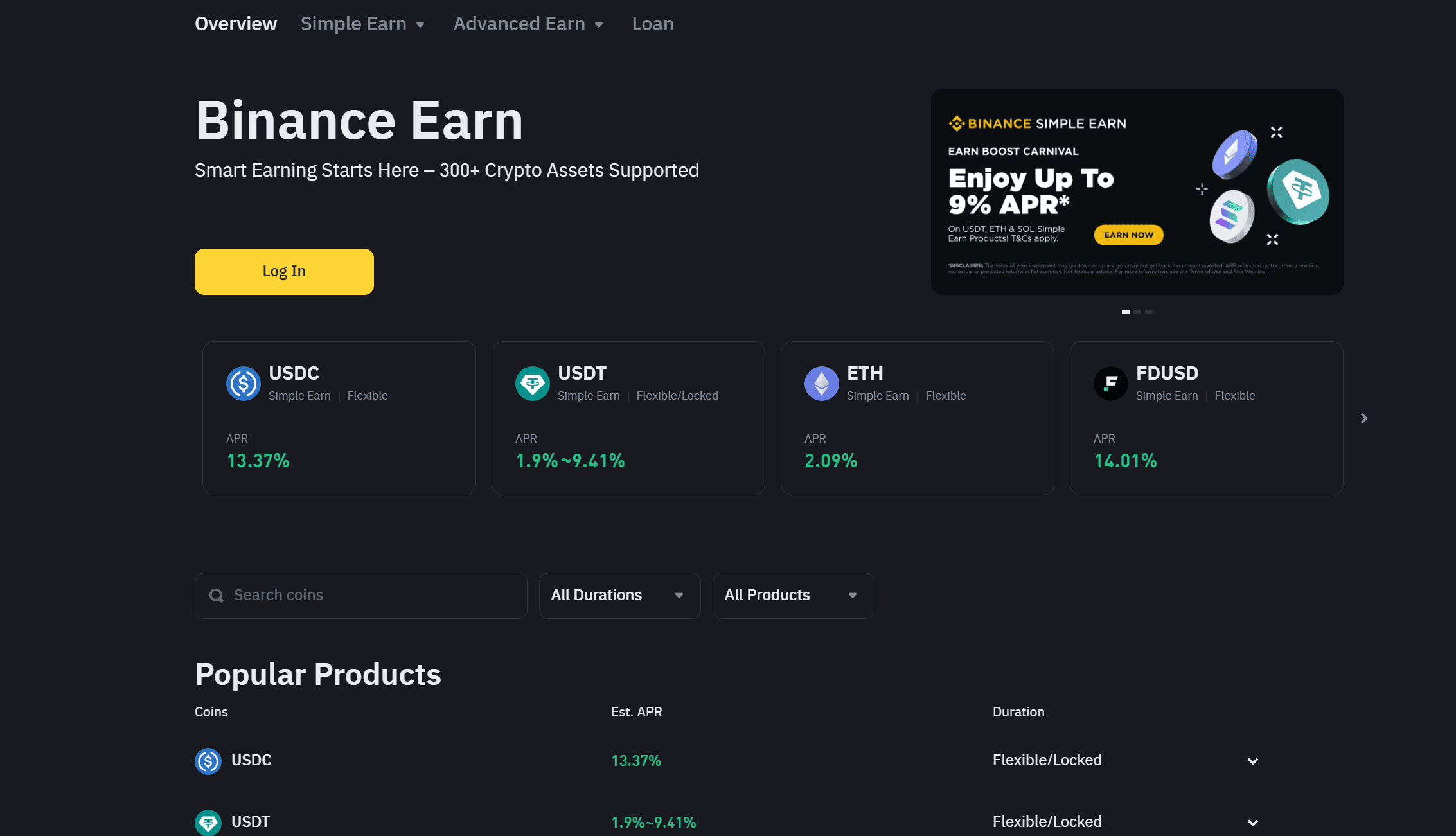

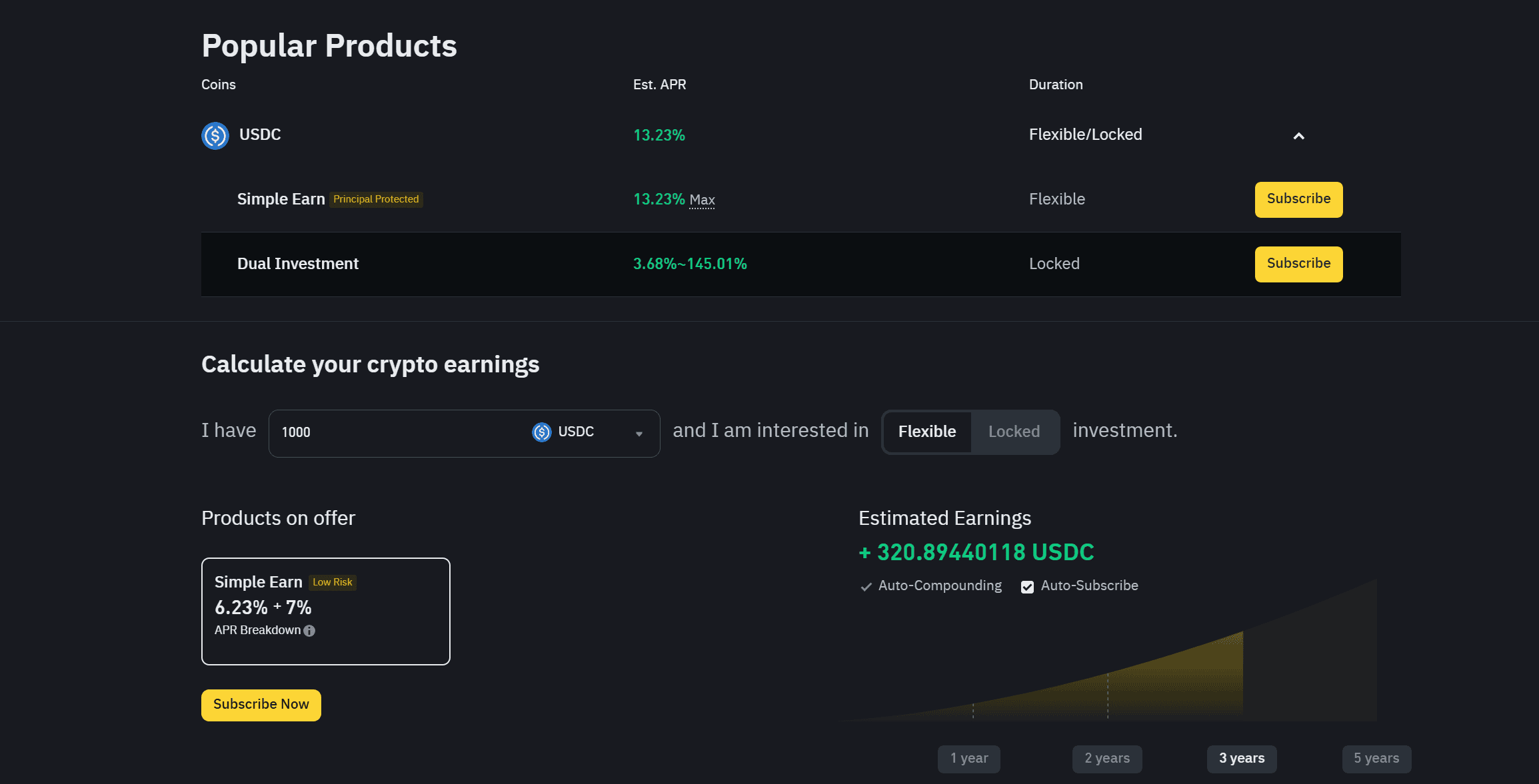

Binance Earn

Binance Earn is a yield-focused providing throughout the Binance ecosystem, designed to assist each novice and skilled traders earn passive earnings on their cryptocurrency holdings.

It serves as a one-stop answer for a number of funding merchandise, championed by its intensive staking program, the place customers can select Locked Staking, the place they deposit their crypto for a set period (e.g., 30, 60, or 90 days) to earn increased rewards.

Key Options of Binance Earn

- DeFi and liquid staking: Connects customers to exterior protocols, providing increased APYs however carrying common dangers related to utilizing these DeFi platforms. Binance additionally helps ETH 2.0 Staking, enabling contributors to stake Ethereum with out working their very own validator node; in return, customers obtain BETH as a tokenized illustration of their staked ETH.

- Financial savings merchandise: Moreover staking, Binance Earn supplies Versatile Financial savings, which permits quick entry to funds however gives extra modest rates of interest. Locked Financial savings, however, require customers to commit their property for a predefined interval in trade for increased yields.

- Twin funding: The platform gives extra superior merchandise like Twin Funding, a high-yield possibility involving two completely different cryptocurrencies with returns contingent on market circumstances.

- BNB Vault: A preferred characteristic for Binance Coin (BNB) holders. It combines mixing staking, financial savings, and liquidity farming multi functional to maximise returns on BNB holdings.

Supported Belongings

Binance Earn helps over 180 cryptocurrencies up for staking, together with main property like Bitcoin, Ethereum, Solana, and Cardano, in addition to stablecoins similar to USDT and USDC.

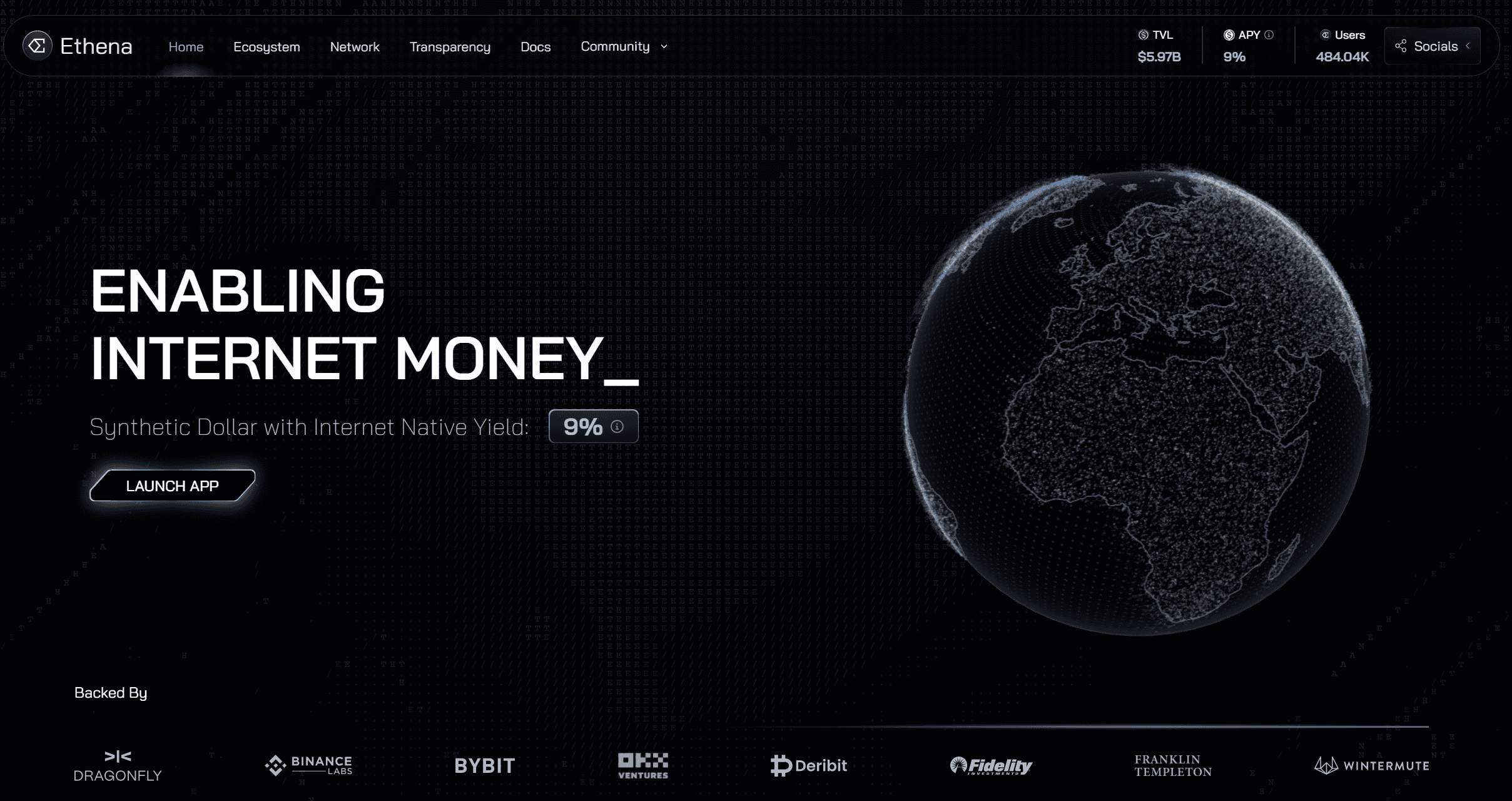

Ethena – A Yield-Bearing Stablecoin Backed by Crypto

Ethena USDe is an artificial greenback stablecoin constructed on Ethereum, designed to keep up a 1:1 peg with the U.S. greenback via delta-neutral hedging and on-chain collateral.

Launched by Ethena Labs, the platform gives a censorship-resistant various to conventional stablecoins. It’s backed completely by crypto property similar to ETH, BTC, and liquid staking derivatives.

Key Options of Ethena

- USDe: Ethena’s USDe employs a delta-neutral hedging mannequin to stability any fluctuations within the worth of its underlying collateral. The protocol takes brief positions on derivatives contracts to maintain the stablecoin pegged at $1 with out relying on fiat reserves or conventional custodians.

- Crypto collateral: All minted USDe is backed by on-chain cryptocurrencies, together with ETH, stETH, BTC, and numerous different stablecoins. This maintains a constant ratio of collateral to excellent tokens.

- Yield-bearing token: Certainly one of Ethena’s hottest choices is the flexibility to stake USDe to earn sUSDe, a yield-bearing spinoff token that appreciates over time. All returns on investments are generated via 1) Ethereum staking rewards and a couple of) the funding spreads earned via delta-neutral derivatives positions. The staking course of follows the ERC-4626 Token Vault standard.

- Insurance coverage fund: Ethena is among the few DeFi protocols to supply a reserve fund that acts as a purchaser of final resort. This fund is a security internet in case of maximum eventualities, like damaging funding charges or sudden market shocks.

Supported Belongings for Staking

Ethena helps staking primarily with its native token, USDe. Upon staking, customers obtain sUSDe, which captures amassed rewards from each derivatives funding spreads and Ethereum staking yields.

The best way to Stake Crypto In a Few Steps

There are a number of methods to stake crypto. However whichever approach, it’s essential to first get a correct crypto pockets to start your staking journey. You’ll be able to take a look at our information on one of the best DeFi wallets to research and examine a number of the prime choices in 2025.

Staking With Crypto Wallets

Some crypto wallets like Belief Pockets, Exodus, and Phantom assist you to stake property straight with out leaving the app.

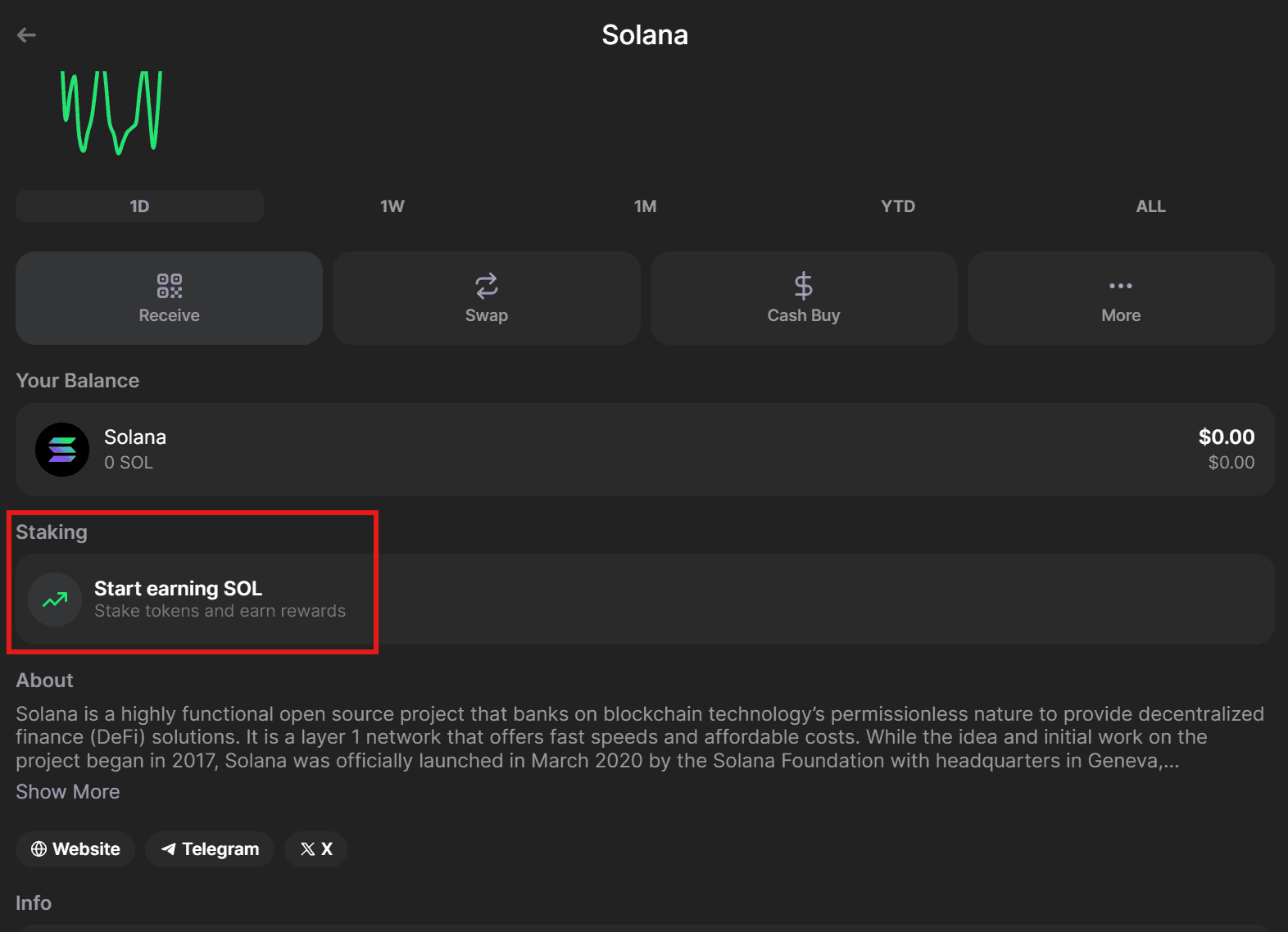

For instance, if you wish to stake using the Phantom wallet, merely go to your account and select an asset. Subsequent, click on on the asset and choose Staking.

Phantom gives two choices: native staking, the place you merely lock up property within the Solana blockchain, and liquid staking utilizing Jito.

In case you select native staking, then you must choose a validator. The Phantom Validator is the preferred as a result of its trustworthiness and safety, however rewards are normally decrease. Afterward, simply enter the quantity you want to stake. Notice that with native staking, your property are locked, so you can not use them throughout dApps for additional yield till the cooldown interval ends.

However, staking with Jito might lead to larger rewards and decrease charges. When you deposit your property, you’ll get JitSOL, which you should utilize throughout DeFi protocols to win some additional rewards.

Utilizing a Staking Platform

Utilizing a crypto pockets, you may be part of a crypto staking pool the place customers deposit their funds to extend the probabilities of incomes rewards. That is splendid for these with smaller quantities of crypto or who can’t meet minimal staking necessities in a given protocol.

For instance, if you wish to stake ETH, you may merely go to Lido, select the variety of tokens you want to stake, click on on proceed, and, after getting achieved so, obtain stETH tokens representing the staked quantity. This lets you use the tokenized model of your funds throughout Ethereum-based DeFi protocols.

Node Staking

Node staking is extra difficult and reserved for individuals who run a validator node on Solana or Ethereum. This implies validators get to stake their very own forex plus the forex of different liquid stakers. You earn rewards by yourself staked property and a fee payment based mostly on the rewards your node generates for liquid stakers.

The most effective swimming pools for node staking is Rocketpool, one of many largest ETH staking swimming pools. It requires not less than 16 ETH to function a node however comes with a 14% reduce from rewards. Different platforms are StakeWise V3 and Marinade Finance for Solana customers.

Change Staking

Another possibility could be centralized staking, during which exchanges like Binance or Coinbase deal with the staking course of in your behalf, simplifying the expertise however requiring belief of their safety measures.

As an example, Binance Earn means that you can select from completely different staking merchandise, from fashionable cryptocurrencies to stablecoins, with completely different durations and APRs.

Often Requested Questions

Can I Unstake My Belongings?

Sure, you may unstake property after a cooldown interval, which will depend on the protocol you’re utilizing. That is to forestall validators from instantly withdrawing their funds, which may enable malicious actors to keep away from penalties, similar to slashing. It additionally helps preserve financial stability by stopping large-scale, sudden withdrawals.

What’s the Distinction Between Native Staking and Liquid Staking?

Native staking requires the consumer to lock property to generate rewards. In the meantime, Liquid staking platforms give customers a tokenized model of their already staked property, which can be utilized throughout completely different DeFi tasks, boosting their incomes potential.

What Makes Restaking Extra Complicated Than Conventional Staking?

Restaking means that you can reuse already staked tokens as collateral in different protocols. This permits customers to compound rewards whereas providing additional safety for a number of decentralized purposes and blockchain protocols. The difficulty is that restaking requires plenty of technical experience in DeFi because the consumer is interacting with a number of sensible contracts and DeFi tasks and should handle the next stage of threat.

The submit The 5 Best Crypto Staking Platforms in 2025: Everything You Need to Know appeared first on CryptoPotato.