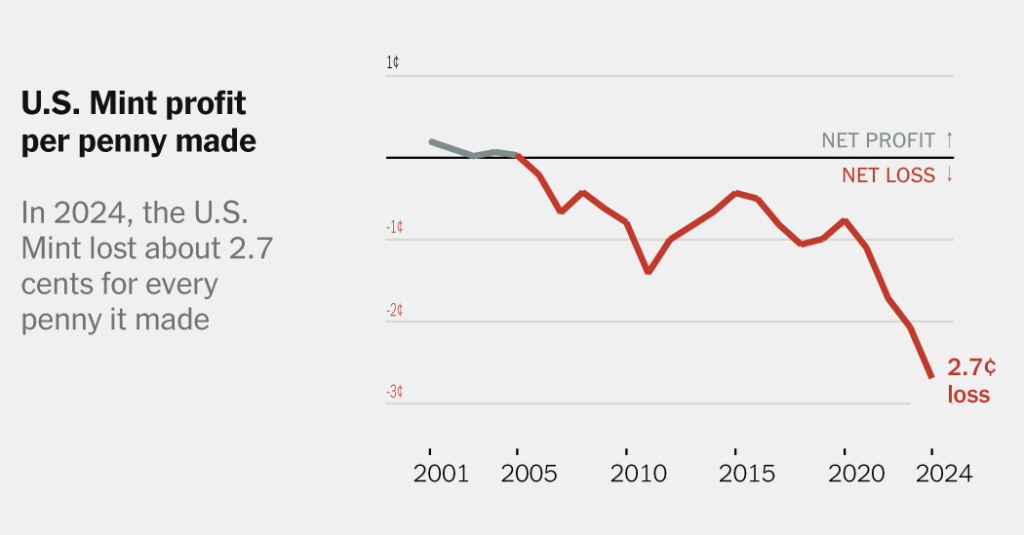

President Trump recently ordered the U.S. Mint to cease producing pennies, for a simple-sounding reason. Every penny, he mentioned, has “actually price us greater than 2 cents.”

He’s proper. Since 2006, the federal government has spent more cash minting pennies than these pennies have been price.

The manufacturing prices of cash will be complicated. A nickel is price half as a lot as a dime however prices twice as a lot to mint. A penny, which used to price lower than 1 cent to make, now prices 3.7. In 2011, 1 / 4 was cheaper to make than a nickel; as we speak the 2 cash price about the identical.

It’s nearly not possible to meaningfully decrease the prices of coin manufacturing. If financial savings is the highest precedence, stopping manufacturing altogether is the one actual possibility, for the easy purpose that manufacturing prices are tied to the costs of particular supplies (principally zinc for pennies, mostly copper for nickels). Rhett Jeppson, a former chief govt of the U.S. Mint, mentioned he noticed some attention-grabbing proposals in his time there, together with the thought of constructing pennies out of plastic, however nothing that might be put into observe.

Since pennies are a transparent money-loser, it appears simple to suppose that eliminating the penny would save taxpayers cash. But it surely’s not that straightforward.

Right here, we discover potential penalties of 4 decisions.

Choice 1: Don’t change something — maintain minting the penny

The U.S. Mint loses cash on each penny and nickel it mints however is worthwhile due to its sale of dimes and quarters. The Federal Reserve buys the cash from the Mint at face worth after which sells the cash to banks, additionally at face worth. In contrast to most authorities businesses, the U.S. Mint receives no appropriations from Congress.

The cash the U.S. Mint has made in extra of prices has declined lately, partly due to rising materials prices. Since 2020, it has averaged over $300 million a yr in earnings from minting frequent cash, although final yr’s earnings, round $100 million, had been decrease than ordinary.

The advantages of the established order are clear: The Mint is predicted to stay worthwhile within the close to future. Taking motion on the penny or every other coin, as we’ll see, comes with trade-offs.

Choice 2: Cease minting the penny

If the Mint did cease minting pennies, it will save about $85 million a yr. Sadly, it will then have greater and costlier downside: the nickel.

“If you happen to do away with the penny, it’ll improve the quantity of nickels,” Mr. Jeppson mentioned. “And also you lose extra on a nickel than you do on a penny.”

Final yr the federal government misplaced 8.8 cents on every nickel it minted (in contrast with 2.7 cents per penny). As a result of many instances extra pennies are minted than nickels, losses had been larger for the penny, however this isn’t all the time the case. In 2023, for instance, the Mint made extra nickels than regular and misplaced $93 million making them in contrast with $86 million in losses making the penny. The scale of the orders for every coin comes from the Federal Reserve, and the orders fluctuate every year, relying on demand.

It’s unclear precisely how excessive demand could be for nickels in a penny-less world, however it’s doubtless that it will be larger than as we speak. And, given their expense, it’s attainable these prices may ultimately swallow up any financial savings gained by eliminating the penny.

There are different results to contemplate, too. Many states have a gross sales tax that specifies taxes collected have to be rounded to the closest cent, so they might most likely have to change their legal guidelines to accommodate money purchases. Shops would wish new rounding insurance policies for purchases made in money.

However it’s attainable to get rid of the penny. Canada did it in 2012, and the Protection Division stopped utilizing pennies on its bases within the Eighties when it determined it wasn’t price the price of delivery them.

Choice 3: Cease minting each the penny and the nickel

Why cease on the penny?

Eliminating the money-losing nickel additionally looks like a logical concept. One downside is a sensible consideration: It could be tougher than you may suppose to make actual change. It could be straightforward to get actual change in case your invoice had been $4.90. However do you really need greater than a greenback in cash if the invoice is $4.85? (If you happen to gave $6, you’d get three quarters and 4 dimes again. Not enjoyable.)

Alternatively, you can tackle this downside by rounding all costs to the closest 10 cents. However this, too, would put strain on the quarter, making it much less helpful for making change. Or it may current curious conditions, like a value for $5.25 when you’ve got 1 / 4, however $5.30 should you don’t. At that time, it could be simpler to spherical each value to the closest 50 cents.

A penny-less and nickel-less world would depart america with solely two cash in huge circulation: dimes and quarters. That may make the U.S. fairly an outlier amongst its peer nations, which have 5 (Canada), six (Japan), six (Australia) or eight (the Eurozone) generally used cash.

Having simply two cash may hasten a pattern away from bodily forex that’s already underway. In 2016, a Federal Reserve examine estimated that money was used for 31 p.c of all funds. In 2023, the Fed’s estimate for share of money funds declined to 16 p.c.

Choice 4: No extra cash

If current developments proceed, the quarter and dime may cross from money-making to money-losing within the subsequent 10 to twenty years. At that time, there could be a powerful case to cease circulating basically all cash.

Nonetheless, even when it stopped making cash for circulation, the U.S. Mint would nonetheless return cash to the Treasury due to the opposite coin merchandise in its portfolio. Final yr the mint revamped $80 million on its numismatic and bullion divisions (suppose collectible cash and funding stage gold). This revenue, which has held regular during the last decade, is simply barely smaller than the $100 million in earnings the circulating coin program returned final yr.

Small change and the large image

Pennies have lengthy been an emblem of presidency waste (the subject was a subplot of a “West Wing” episode more than 20 years ago). And, whereas cash is cash, the general influence of those decisions is measured in hundreds of thousands of {dollars} — not billions or trillions, the items you’re more likely to come across when doing math on the scale of the federal funds.

Coverage choices on paper forex are extra consequential than these on cash. By financial worth, cash account for simply 2 p.c of cash in circulation. Paper forex will not be manufactured by the Mint and its accounting is completely different, however its printing remains to be constructive for the federal government. As a result of there isn’t a curiosity on these notes, the paper cash in circulation gives a benefit to the federal government much like an interest-free mortgage.

However the money ecosystem additionally has its drawbacks. The federal government’s major income is tax assortment, not coin minting. Research have estimated that over $100 billion of revenue goes unreported every year due to money transactions, amounting to tens of billions in misplaced tax income.

If eliminating cash led to even a modest lower in untraceable transactions, the results might be far larger than the earnings or losses of the U.S. Mint.