I received to considering the opposite day that Trump’s plan to decrease mortgage charges could be by way of elevated unemployment.

Whereas everyone seems to be seemingly targeted on the opposite aspect of the coin, inflation, possibly it’s the incorrect place to look.

We’ve been speaking about tariffs and deportations when possibly we needs to be speaking about all the roles being eradicated in Washington and past.

Bear in mind, the Fed’s twin mandate is worth stability and sustainable employment.

If we see a surge of layoffs, which we’re already seeing, the Fed may very well be compelled to behave.

DOGE Says Name My Bluff on Authorities Layoffs

When Trump was working for his second time period, he promised to scale back federal spending and the scale of the federal authorities.

Serving to him fulfill this tough mission was Elon Musk, who paradoxically unveiled the “Division of Authorities Effectivity,” or DOGE for brief.

For those who want some fast background on that, it’s mainly a play on the longstanding Doge meme, which is a Shiba Inu canine that emerged within the early 2010s.

The true-life canine named Kabosu was pictured with foolish, broken-English textual content overlays that used modifiers like “such” and “a lot.”

For instance, if I have been to create one (which I simply did above) for what’s occurring with all these job cuts, it’d say one thing “a lot layoffs,” “such unemployment,” and “wow.”

And whereas it’s all completely absurd on the floor, all of it received very actual when the layoff bulletins got here streaming in.

The DOGE authorities group launched a few month in the past and it’s been nonstop authorities layoffs ever since.

In the meantime, the tariffs we all feared would drive inflation we’re largely placed on maintain, apart from China’s.

So maybe we must always concentrate on jobs (sustainable employment) as an alternative of inflation (worth stability) when wanting on the total financial image.

1000’s of Authorities Layoffs and Buyouts Have Already Taken Place, with Extra to Come

Whereas it’s unclear simply what number of authorities jobs have been extinguished, both by way of layoffs or buyouts, it’s not a small quantity.

And it doesn’t look like over both. If we merely think about buyouts, roughly 75,000 federal staff accepted the deferred buyout program, per the U.S. Workplace of Personnel Administration.

On the similar time, hundreds of presidency workers have been terminated at quite a lot of excessive stage companies, together with the Division of Power, the Division of Schooling, EPA, and plenty of others.

Then there’s the near-shutting down of the CFPB, mass firings on the IRS, and the 1,000+ job cuts on the Division of Veterans Affairs (VA).

Oh, and information that half of the workers at Division of Housing and City Growth (HUD) have been let go.

In different phrases, the DOGE initiative may be very actual and the fallout goes to be huge. We do not know simply how huge but, nevertheless it’s clear numerous jobs are being misplaced.

There are reportedly 2.3 million civilian staff within the federal authorities and it seems many are being focused in a method or one other.

On prime of that, there’s attrition, the place authorities staff depart voluntarily or give up, maybe in a type of protest.

I truly know a person who has determined to go away. In some unspecified time in the future, all of that is going to point out up within the employment knowledge.

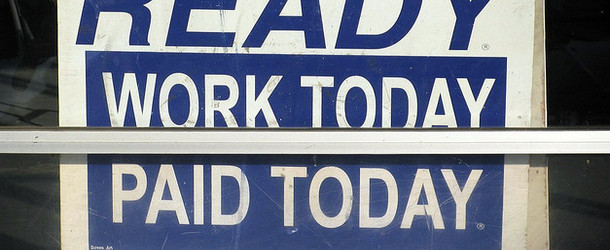

And should you weren’t conscious, the jobs report can impact mortgage rates in a major way.

Lengthy story quick, the bleaker the job image, the decrease mortgage charges are inclined to go, because it indicators a weakening financial system and maybe cooler inflation.

Trump Isn’t Counting on the Fed, However Would possibly Power Their Hand Anyway

That brings us again to the Fed. Whereas newly-appointed Treasury Secretary Scott Bessent mentioned final week that Trump isn’t going to ask the Fed to lower rates, it may go that manner anyway.

Whereas he mentioned Trump was targeted on the 10-year bond yield, which correlates well with 30-year mortgage rates, the Fed should be compelled to behave.

If the unemployment price will increase considerably because of all the federal government job losses, the Fed could must recalibrate its financial coverage. It may additionally throw off their “delicate touchdown.”

And although there’s not a direct effect of Fed rate cuts on long-term mortgage rates, they do are inclined to share a directional part.

In different phrases, if the Fed is slicing extra resulting from a deteriorating financial system, likelihood is 10-year bond yields will probably be falling as nicely, possible earlier than the Fed cuts.

This could point out decrease mortgage charges previous to the Fed getting round to slicing, and within the course of, could be a roundabout manner of reaching the objective of decrease rates of interest for customers.

After all, it will be on the expense of doubtless hundreds of thousands of presidency jobs, for which it’s unclear if there could be a alternative.

So ultimately, the 30-year fastened would possibly trickle all the way down to the low-6s and even high-5s this 12 months if that occurs, however not with out critical financial fallout.

It additionally makes you marvel what’s going to occur in areas with a excessive focus of presidency staff, resembling in and round Washington D.C.

I’ve already heard that for-sale listings have jumped up, although we’ll want extra time to see how actual that story is.

But it surely may damage native housing markets, assuming these householders up and depart.

Nevertheless, one would possibly query the place they’d go in the event that they have already got one of the best deal on the town in the way in which of a 2-4% 30-year fixed-rate mortgage.

Learn on: 2025 mortgage rate predictions