Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

U.S. single-family residence costs, as measured by the Freddie Mac Home Worth Index (which makes use of the repeat-sales methodology), rose 3.9% within the calendar 12 months 2024. Throughout that very same timeframe, overall U.S. consumer prices rose 2.9%.

Among the many 384 metro-area housing markets that the Freddie Mac Home Worth Index tracks courting again to 1975, these are the ten metros that noticed the largest year-over-year residence value enhance in 2024:

- Kingston, New York: +13.5%

- Springfield, Ohio: +11.8%

- Glens Falls, New York: +11.7%

- Binghamton, New York: +11.5%

- Cumberland, Marylandd-West Virginia: +11.4%

- Syracuse, New York: +10.9%

- Utica-Rome, New York: +10.5%

- Atlantic Metropolis-Hammonton, New Jersey: +10.5%

- Jacksonville, North Carolina: +10.3%

- Vineland-Bridgeton, New Jersey: +10.3%

Amongst those self same 384 metro-area housing markets, these 10 metros noticed the largest year-over-year residence value decline in 2024:

- Punta Gorda, Florida: -8.6%

- Cape Coral-Fort Myers, Florida: -7.6%

- North Port-Sarasota-Bradenton, Florida: -4.7%

- Homosassa Springs, Florida: -3.3%

- Sebastian-Vero Seashore, Florida: -3.2%

- Lakeland-Winter Haven, Florida: -2.7%

- Austin-Spherical Rock-Georgetown, Texas: -2.5%

- San Antonio-New Braunfels, Texas: -2.3%

- Ocala, Florida: -1.9%

- Crestview-Fort Walton Seashore-Destin, Florida: -1.8%

!operate(){“use strict”;window.addEventListener(“message”,(operate(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r=0;r<e.size;r++)if(e[r].contentWindow===a.supply){var i=a.knowledge["datawrapper-height"][t]+"px";e[r].model.top=i}}}))}();

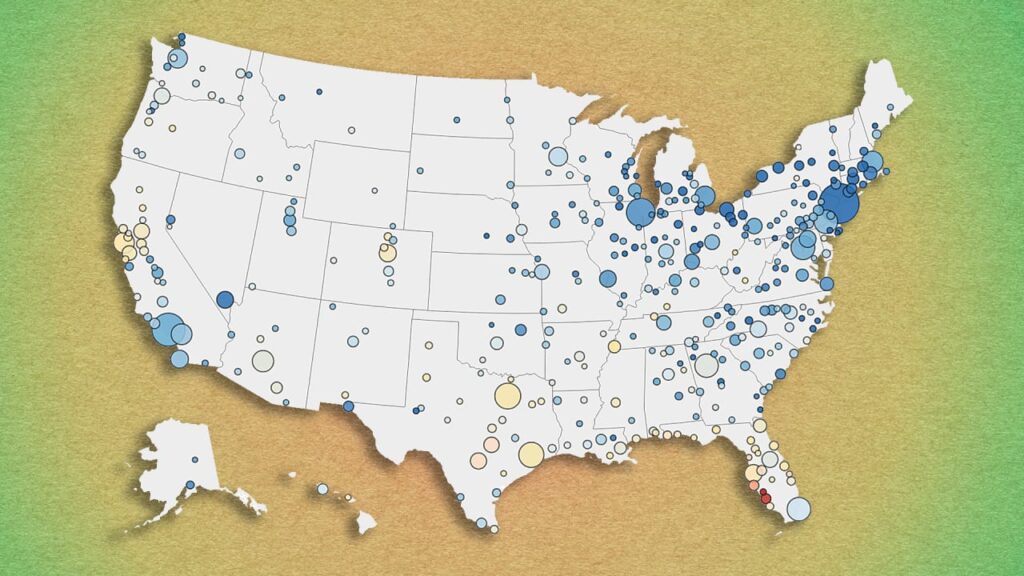

The map above reveals the year-over-year change in metro-area residence costs from December 2023 to December 2024.

The map beneath reveals how metro-area residence costs on the finish of 2024 evaluate to that respective market’s peak in 2022.

For instance, whereas residence costs within the Austin metro space are down 2.5% 12 months over 12 months, the market can be 15.8% beneath its 2022 peak, based on the Freddie Mac Home Worth Index.

Click here to view an interactive model of the map beneath.

!operate(){“use strict”;window.addEventListener(“message”,(operate(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r=0;r<e.size;r++)if(e[r].contentWindow===a.supply){var i=a.knowledge["datawrapper-height"][t]+"px";e[r].model.top=i}}}))}();

Whereas some Western markets (which noticed most of their declines within the second half of 2022) and Southern markets are nonetheless beneath their peak 2022 pricing, each market within the Freddie Mac Home Worth Index stays above March 2020 ranges.

Nationwide residence costs, based on the Freddie Mac Home Worth Index, are 48.5% above March 2020 ranges. Throughout that very same timeframe, total U.S. client costs rose 23.1%.

!operate(){“use strict”;window.addEventListener(“message”,(operate(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r=0;r<e.size;r++)if(e[r].contentWindow===a.supply){var i=a.knowledge["datawrapper-height"][t]+"px";e[r].model.top=i}}}))}();

ResiClub’s month-to-month home price tracker and housing inventory tracker (with knowledge on greater than 800 metros/micro areas and greater than 3,000 counties) have intently detailed these regional developments.

Source link