Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Speaking before the U.S. Senate this month, Federal Reserve Chair Jerome Powell stated {that a} decade or extra down the highway, owners in some elements of the nation won’t be able to find home insurance.

“Each banks and insurance coverage firms are pulling out of coastal areas or areas the place there are plenty of fires. So what that’s going to imply is that if you happen to fast-forward 10 or 15 years, there are going to be areas of the nation the place you possibly can’t get a mortgage,” Powell advised Congress. “There received’t be [mortgage] ATMs, there received’t be banks [lending mortgages], so it’ll fall on owners and residents. But it surely’ll additionally fall on state and native governments. Which is what you see taking place now, the place they’re stepping in, in states the place insurance coverage goes away. You’re seeing states step in as a result of they need these areas to stay affluent.”

Listening to that remark made by a professor or analyst is one factor. However listening to it come from the Fed Chair is a bit unnerving for the housing sector. It raises the query: Is there any knowledge on the market to recommend which housing markets may very well be on the highest threat of financial institution and residential insurer pullbacks?

ResiClub did some digging and located a brand new proprietary evaluation made by First Avenue, which forecasts—based on models estimating property-specific threat and anticipated local weather threat—how a lot county-level dwelling insurance coverage premiums might shift between 2025 and 2055.

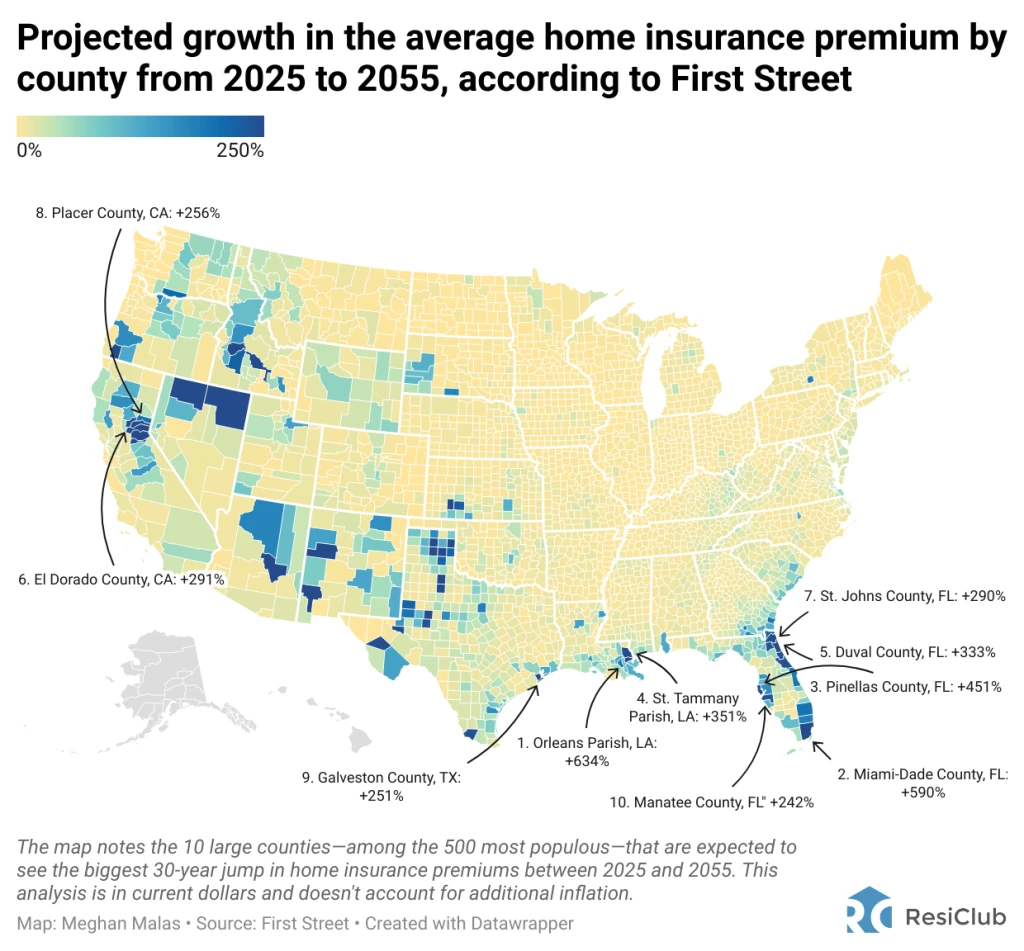

To see the place owners and traders may very well be impacted essentially the most, ResiClub visualized First Avenue’s county-level dwelling insurance coverage forecasts. (Please be aware that forecasting usually isn’t ever assured—not to mention when a agency is attempting to mission three complete a long time into the longer term. If you happen to went again and located 30-year forecasts for something finance-related made in 1995, they’d possible be fairly far off from how issues transpired by 2025.)

We requested First Avenue if their evaluation accounted for future inflation as effectively. “These [insurance] values are primarily based on in the present day’s {dollars} with the one adjustment being associated to the rise in local weather publicity over time, however to not any expectations round inflation or market changes. . . . These values should not inflation adjusted in any approach,” First Avenue tells ResiClub.

Among the many 500 most populous counties, these are the 20 the place First Avenue expects the best 30-year progress in dwelling insurance coverage premiums:

- Orleans Parish, Louisiana: +634%

- Miami-Dade County, Florida: +590%

- Pinellas County, Florida: +451%

- St. Tammany Parish, Louisiana: +351%

- Duval County, Florida: +333%

- El Dorado County, California: +291%

- St. Johns County, Florida: +290%

- Placer County, California: +256%

- Galveston County, Texas: +251%

- Manatee County, Florida: +242%

- Volusia County, Florida: +242%

- Clay County, Florida: +240%

- Palm Seashore County, Florida: +195%

- Brevard County, Florida: +189%

- Broward County, Florida: +182%

- Coconino County, Arizona: +173%

- Hillsborough County, Florida: +162%

- Nueces County, Texas: +158%

- Hernando County, Florida: +152%

- Lafayette Parish, Louisiana: +149%

The heightened threat of flooding, hurricanes, and tropical storms is in the end why the First Avenue mannequin tasks the best insurance coverage hikes across the Gulf. In actual fact, 12 of the 20 main U.S. counties anticipated to see the largest enhance are in Florida.

As ResiClub has previously reported, owners in these areas are already experiencing elevated insurance coverage hikes. Whereas the median annual U.S. dwelling insurance coverage premium elevated by 33% between the tip of 2020 and the tip of 2023, it surged greater than 80% in lots of Florida counties.