Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

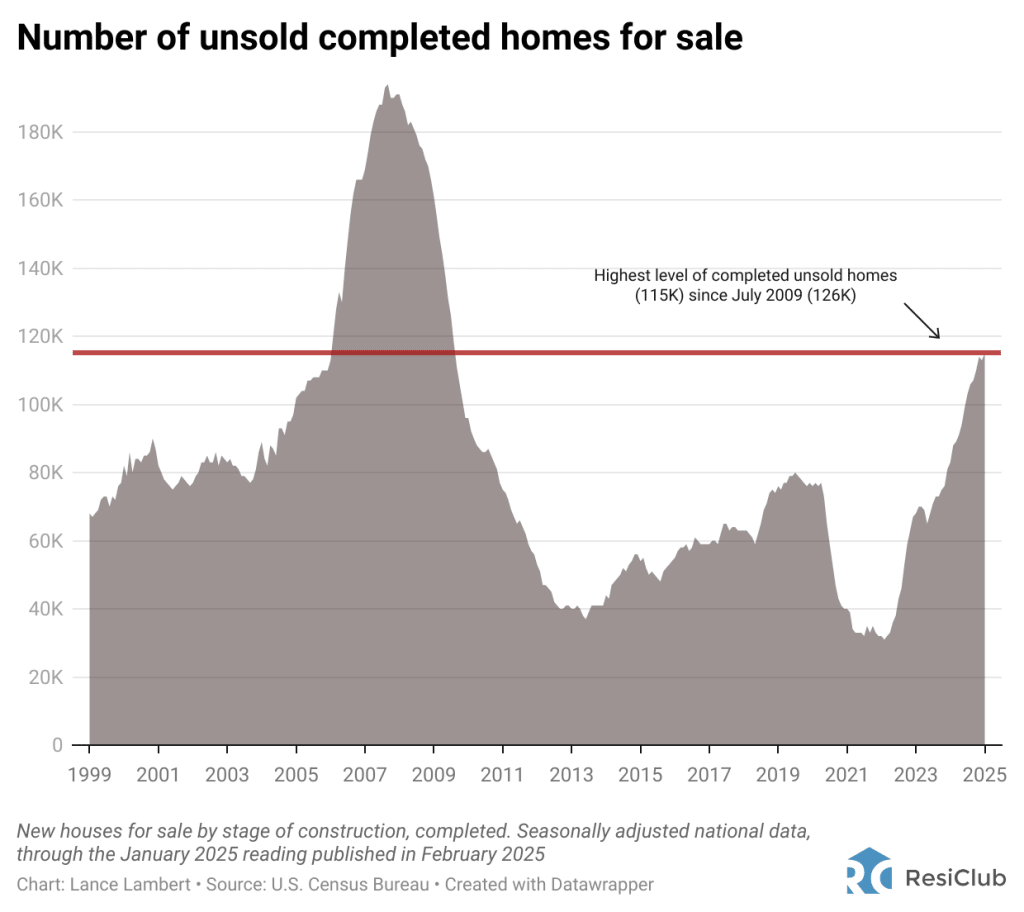

Because the pandemic housing increase fizzled out, the variety of unsold completed U.S. new single-family homes has been rising. Right here’s a take a look at the current historic numbers for January:

January 2018: 63,000

January 2019: 76,000

January 2020: 76,000

January 2021: 40,000

January 2022: 32,000

January 2023: 68,000

January 2024: 83,000

January 2025: 115,000

The January determine (115,000 unsold accomplished new houses) that not too long ago revealed is the very best degree since July 2009 (126,000). Let’s take a better take a look at the info to higher perceive what this might imply.

To place the variety of unsold accomplished new single-family houses into historic context, ResiClub created a brand new index: ResiClub’s Completed Properties Provide Index.

The index is one easy calculation: The number of unsold completed U.S. new single-family homes divided by the annualized rate of U.S. single-family housing starts.

The next index rating signifies a softer nationwide new building market with better provide slack, whereas a decrease index rating signifies a tighter new building market with much less provide slack.

Massive image: The index exhibits that there’s extra new building slack within the 2025 housing market as in comparison with the 2023 and 2024 markets; nonetheless, it’s nonetheless far much less slack than the 2008 housing bust.

In housing markets and builder communities the place unsold accomplished stock will get too excessive, native homebuilders may (and a few have already got) flip to get larger affordability changes (i.e., larger incentives and even outright value cuts).

That raises the query: The place is that this unsold new house stock positioned? The place can consumers discover offers?

Whereas the U.S. Census Bureau doesn’t specify the places of unsold accomplished single-family new building, it’s secure to imagine that almost all of it’s within the South, primarily based on where total active housing inventory for sale is increasing and the place homebuilders are finishing essentially the most houses (see chart under).

As ResiClub has documented, each lively resale and new houses on the market stay essentially the most restricted throughout enormous swaths of the Midwest, Northeast, and Southern California. That’s possible the place you’ll discover the least unsold accomplished new building—and the place builders have better pricing energy.

In distinction, lively housing stock on the market has grown essentially the most within the Gulf area, together with housing markets like Tampa, Punta Gorda, and San Antonio. These areas noticed main value surges throughout the pandemic housing increase, with house value development outpacing native earnings ranges. As pandemic-driven migration slowed and mortgage charges rose, markets like Tampa and Austin confronted challenges, counting on native earnings ranges to help frothy house costs.

This softening pattern is additional compounded by an abundance of recent house provide within the Solar Belt. Builders are sometimes prepared to decrease costs or supply affordability incentives to keep up gross sales, which additionally has a cooling impact on the resale market. Some consumers, who would have beforehand thought-about present houses, are actually choosing new houses with extra favorable offers.

“The variety of builders’ unsold stock houses stays above the seasonal norm,” wrote Dillan Krieg, a analysis analyst at John Burns Analysis and Consulting on LinkedIn. “We’ve been monitoring this pattern for some time as builders depend on speculative begins to seize consumers. Nonetheless, some builders are dealing with pricing strain—particularly in key Florida and Texas markets, the place resale provide can also be effectively above pre-COVID norms.”