Earlier than the Civil Battle, the US monetary markets operated in a world far faraway from right this moment’s fast-paced buying and selling flooring. Auctions have been held solely twice each day and newspapers served as a main supply of commerce reviews. Understanding these early market behaviors, from the rise of railroads to the impression of the Panic of 1837, sheds mild on the dangers and alternatives that formed the muse of right this moment’s monetary methods.

This historic narrative uncovers classes essential for contemporary analysts navigating an ever-changing panorama. It’s the remaining in a three-part sequence (Part I, Part II).

Step Again in Time

After we return in time earlier than the Civil Battle, the inventory market seems very totally different from right this moment. There was trade buying and selling, however there was no specialist at a put up, nor was buying and selling steady. Somewhat, auctions have been held twice a day. The names of listed shares have been known as in flip. The announcer paused to see if a bid or an ask, or multiple, was shouted out, and if any have been matched they have been recorded within the books as a commerce.

Most shares didn’t commerce day-after-day on this period. When the provides ceased to be shouted or within the absence of any provides, the announcer continued down the checklist to the subsequent inventory. In lots of circumstances neither the bid nor ask, if any, have been matched on the public sale. As a substitute, bids and asks served solely as beginning factors, an anchor to set expectations, with the precise commerce going down later, on the street. These trades could have been reported within the newspapers however weren’t discovered within the NYSE data.

Fortuitously for historic evaluation, inventory trades have been reported within the each day newspapers from the start. “Costs of Shares,” as these sections have been typically labelled, have at all times been newsworthy. In actual fact, some years in the past a crew led by Richard Sylla of New York College was in a position to compile a vast archive of newspaper worth quotes earlier than the Civil Battle. You could be astonished to study simply what number of shares have buying and selling data that stretch again to the Battle of 1812 and earlier. It is just earlier than 1800 that the variety of quoted shares thins to a handful.

New York Was Not the Epicenter of Finance

One other key level of distinction: the New York Inventory Alternate didn’t obtain nationwide predominance till after the 1840s. To acquire cheap protection of complete market capitalization, a inventory market index for this era should embody shares traded in Boston, Philadelphia, and Baltimore. In actual fact, on the outset of this era, Philadelphia was the monetary middle of the USA.

New York didn’t take the lead till the Panic of 1837, and consolidation of its main function was nonetheless in course of at first of the Civil Battle. There have been rival exchanges in NY city itself, in addition to different cities, by means of the 1860s. True predominance for the NYSE awaited the post-war knitting collectively of the nation by railroad, telegraph, and ticker.

The non-dominance of New York was not properly understood earlier than Richard Sylla’s work. Jeremy Siegel’s path-breaking compilation of inventory returns to 1802 used solely shares listed in New York for a lot of the antebellum interval. That is true for the Goetzmann, Ibbotson and Peng dataset again to 1815.

I consider utilizing solely shares listed in New York introduces appreciable survivorship bias. There’s a purpose that the NYSE in the end rose to nationwide dominance. Financial, political, and monetary situations have been extra favorable for wealth accumulation by means of investing in New York Metropolis than wherever else. I discovered a lot decrease inventory returns in Philadelphia and Baltimore, with extra failures and busts, which had the impact of considerably decreasing the inventory returns reported in my paper within the Financial Analysts Journal, relative to these reported in Jeremy Siegel’s e-book, Stocks for the Long Run.

Nonetheless, from 1793 onward there’s a US inventory market, with a number of shares listed and buying and selling, with historic report. For shares, this era will be divided into two, with the Panic of 1837 serving because the hinge.

From 1793 to the Panic of 1837

As of January 1793 I might discover one financial institution every buying and selling in New York, Boston, and Philadelphia, together with the 1st Financial institution of the USA (traded on all exchanges), every with a worth report and knowledge on share rely and dividends. There are quotes within the Sylla database from earlier than 1793, together with in the course of the first market panic in 1792, however I couldn’t extract a worth and dividend report that I judged reliable earlier than January 1793.

For the primary dozen years nearly all of inventory market capitalization consisted of business banks. There was no different traded sector. By the Battle of 1812, there had appeared a number of insurance coverage corporations and a handful of turnpike shares, however banks nonetheless dominated. After the battle, marine and fireplace insurance coverage corporations proliferated, particularly in New York, in order that for the primary time the market contained two sectors of roughly equal weight; or maybe just one sector, the monetary sector, if financial institution and insurance coverage shares are lumped collectively. The collective capitalization of the monetary companies sector vastly exceeded the handful of transportation and manufacturing shares that traded earlier than 1830.

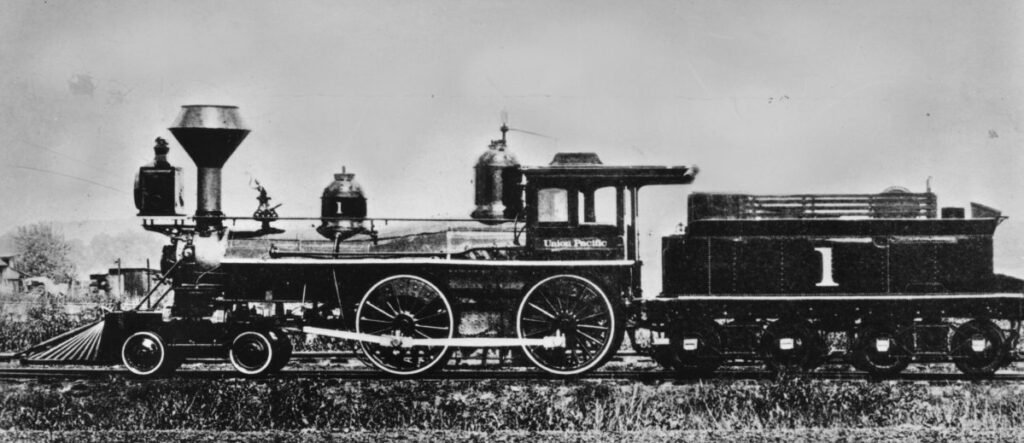

In 1830, railroad shares started to be traded in New York and shortly got here to dominate buying and selling quantity. Even a small railroad would have capitalization the dimensions of a big financial institution. Because the Panic of 1837 started, complete railroad cap was approaching that of the insurance coverage sector. By the tip of the melancholy that adopted, in 1843, after the failure of quite a few banks and insurance coverage corporations, the still-expanding railroad sector had a market cap about the identical as the whole traded monetary sector.

By the tip of the interval, banks and insurance coverage corporations had moved off-exchange. From 1845 till close to the tip of the century, the US inventory market — evaluated when it comes to capitalization, and specializing in the NYSE — grew to become nearly completely a market of railroad shares.

From the Panic of 1837 to the Civil Battle

The railroad sector continued to increase till the bust within the Fall of 1857 — a extreme however very temporary inventory market plunge, moderately like October 1987. It was seen in a month-to-month index however nearly invisible in an annual report. Stronger railroads recovered, however weaker roads continued to float down in worth by means of the onset of the Civil Battle.

On the nadir, shares which had bought for $100 some years earlier than have been buying and selling in single digits. There was widespread suspension of dividends. My index of actual complete return on shares over two- and three-decade home windows reaches a generational low on the finish of the 1850s.

The Civil Battle noticed railroad shares within the North soar in worth. Wealthy dividends of 8% to 10% quickly resumed as income exploded to fulfill the calls for of wartime mobilization. Southern railroads, which had not often traded on the main inventory exchanges, all of which have been within the North, have been principally destroyed. Analysts ought to acknowledge that the historic report of the 1860s, as at the moment compiled, contains solely shares of the victorious Union. The substantial variety of financial institution and railroad shares domiciled within the Accomplice states, which principally went to zero over the course of the battle, are usually not a part of the historic report of US inventory market returns.

Bonds

Alexander Hamilton’s refunding of the Revolutionary Battle debt within the early 1790s created the US Treasury market. I’ve information on Treasury returns, for comparability with shares, from January 1793.

Nevertheless, the bond market report is as soon as once more extra sophisticated than the inventory market report. As an example, Hamilton’s bonds had no acknowledged maturity, therefore no yield to maturity will be calculated.

Most notably, at first of 1835 President Andrew Jackson paid off the remaining US debt. There could be no lengthy Treasuries (“funded debt” within the idiom of the day) obtainable to be bought till late in 1842.

Starting with Sidney Homer’s Historical past of Curiosity Charges, and persevering with with Jeremy Siegel’s work, the momentary disappearance of Treasuries has been dealt with by substituting another form of authorities bond, state or municipal. From the late 1820s there are a dozen municipal issuers with a report within the Sylla archive.

Sadly, a number of states defaulted in the course of the melancholy that adopted the Panic of 1837, making a mockery of the concept that a “authorities bond” is a proxy for a risk-free, or at the very least default-free instrument, appropriate to function a foil for assessing fairness danger.

Earlier than the Panic, the issuers that in the end defaulted (similar to Pennsylvania and Maryland) couldn’t be distinguished from issuers that got here by means of the melancholy with out incident (Boston, Philadelphia).

The historian who requires a foil for equities can use hindsight to pick out a municipal issuer that didn’t default; however the investor of the time didn’t take pleasure in such hindsight, making any account of “fairness danger” false. Lengthy story quick: it’s questionable whether or not authorities bonds have been any much less dangerous than shares by means of a lot of this early interval.

Final, the company bond market didn’t come into being till simply earlier than the Civil Battle. It burst on the scene within the mid-1850s. By the tip of the Civil Battle, the company bond market had achieved a roughly fashionable contour, with particular person bonds priced in keeping with perceived credit score high quality and common flotations of recent points. Two caveats: most company bonds have been from a single sector, railroads. And the shortest maturity bond issued was usually 10 years, with 20.- and 30-year bonds extra widespread, till the Eighteen Eighties, when 40-, 50-, and 100-year bonds started to proliferate.

Key Takeaways

I hope you gleaned a couple of tidbits from this sequence — a really speedy tour by means of 230 years of US market historical past. Listed below are a couple of takeaways to remember as you learn different historic accounts.

- For shares, the Civil Battle is the important thing turning level. Afterward, it’s arguably one steady market report down to the current. Beforehand, the inventory market seemed very totally different.

- For bonds, World Battle I marks the dividing line between an primarily fashionable Treasury market and one thing fairly totally different. Take into account that earlier than 1913 there was no Federal Reserve. Somewhat, there had been two abortive makes an attempt to determine a central financial institution within the US, the 1st and a couple ofnd Banks of the USA, the one was closed up by govt order in 1811, and the opposite was destroyed by govt order within the 1830s.

- In a two-century view, there isn’t any purpose to suppose that inventory and bond returns obtained over latest many years are going to generalize all through the report. The very totally different market construction and composition permits for the potential for very totally different returns for shares, and for shares relative to bonds, in additional distant many years.

- The aim of historic work is to not get hold of a bigger pattern measurement to present a extra exact estimate of the imply anticipated return. Somewhat, the aim is to know how various things have been up to now, to higher perceive the vary of prospects for the longer term.

Sources

- Spreadsheets containing the Richard Sylla information will be downloaded from EH.web: [https://eh.net/database/early-u-s-securities-prices/]. These are worth quotes solely however embody bonds in addition to shares.

- The web appendix to my paper on the FAJ incorporates each a information to the Sylla and different historic compilations, and a hyperlink to my element spreadsheet, the place you will discover the person shares I used (chosen from these with report in Sylla), together with their share rely and dividend payouts (the latter two not in Sylla).

- A Guide for Investment Analysts: Working with Historical Market Data

- A Guide for Investment Analysts: Toward a Longer View of US Financial Markets