The Trump administration is quickly delivering wins to American firms by rolling again rules, pausing investigations and retreating from lawsuits accusing employers of discrimination.

A mixture of firings, stop-work orders and litigation pauses has hobbled regulators just like the Shopper Monetary Safety Bureau, the Equal Employment Alternative Fee, the Nationwide Labor Relations Board, and the Securities and Change Fee.

The strikes have led the S.E.C. to drag again on its try and police the cryptocurrency growth and upended efforts at different businesses to guard employee rights.

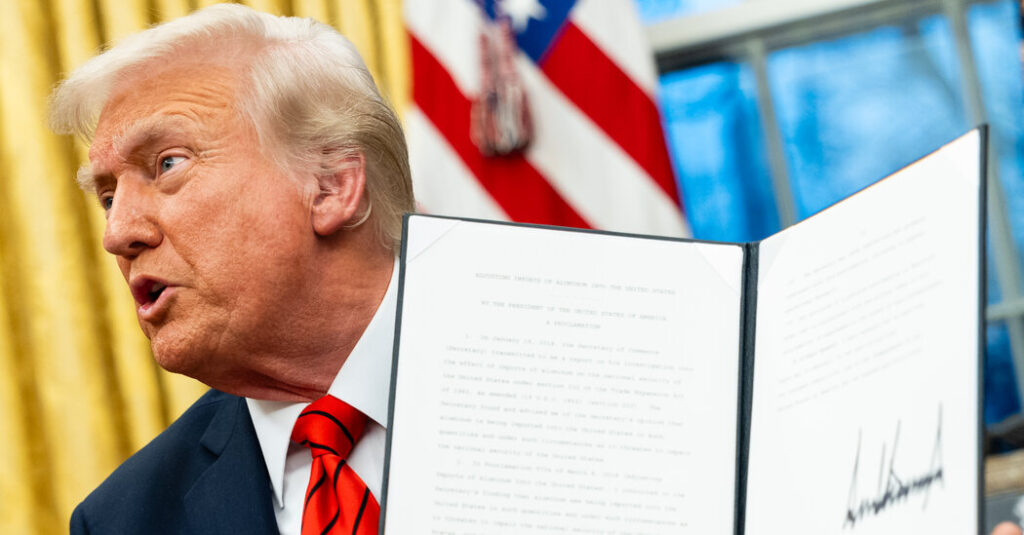

The velocity and scale of the deregulatory strikes by President Trump replicate his formidable agenda to downsize authorities.

However the upshot of all this upheaval is straightforward: Regulatory businesses which might be meant to guard bizarre Individuals, staff and owners are being gutted, shopper advocates say.

“Below the Trump administration, federal shopper protections are being quickly stripped away in a lawless course of,” mentioned Adam Levitin, a professor at Georgetown Legislation who focuses on monetary regulation. “That is deregulation by firings.”

It’s not unusual for a brand new administration to pause some guidelines and rules enacted beneath an earlier administration to make sure they replicate a brand new president’s priorities.

However Mr. Trump’s plan to shrink the federal work drive via buyouts and mass firings might complicate the ability of regulators to do their jobs and is neutering these businesses. On Tuesday night dozens of workers on the shopper bureau and the Small Business Administration were fired.

Among the Trump administration’s coverage modifications are in line with a collection of sweeping government orders the president signed to stamp out applications defending the rights of transgender folks or local weather change initiatives.

The Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency each moved shortly to withdraw from a world local weather change group made up of financial institution supervisors.

One change to a federal housing program that was meant to guard towards gender discrimination has overtly non secular underpinnings.

Scott Turner, the brand new secretary of the Division of Housing and City Improvement, announced Friday that HUD’s workers was halting enforcement actions that additional a “far-left gender ideology” in relation to housing applications. He mentioned the 2016 rule was inconsistent with “what the Lord established from the start when he created man in His personal picture.”

The overhaul of the Shopper Monetary Safety Bureau quantities, in impact, to the closure of the roughly 1,700-employee company, which regulates monetary companies firms. All work on the bureau has been halted this week.

The Trump administration didn’t reply to a request for remark.

Enterprise teams just like the U.S. Chamber of Commerce have lengthy favored regulatory reduction and in a report in January listed it as considered one of its high priorities for the yr. Specifically, the chamber mentioned the patron bureau had engaged in “egregious” overreach.

Kristin E. Hickman, a professor on the College of Minnesota Legislation College who focuses on administrative regulation, mentioned irrespective of the threats, solely Congress might get rid of a congressionally created company like the patron bureau. However she additionally famous that presidents had latitude in how a lot authority they might give to an company.

She mentioned there was “loads of wiggle room” when it got here to the flexibility to “broaden or shrink what an company is doing.”

Right here’s a more in-depth have a look at a number of the extra vital modifications happening at regulatory businesses beneath the Trump administration:

Shopper Monetary Safety Bureau

Russell Vought, whom Mr. Trump tapped to steer the Workplace of Administration and Funds, wasted no time throughout his first few days as performing director of the patron bureau, the federal watchdog created within the wake of the monetary disaster.

He shortly ordered employees on the company to close down all “supervision and examination exercise.” He directed the bureau’s attorneys to ask a decide to delay a rule that will require credit-reporting firms to maintain medical debt off customers’ credit score scores. He shut the company’s places of work for every week.

And on Tuesday night time, greater than 70 workers, together with enforcement attorneys, have been laid off. The firings occurred simply hours earlier than Mr. Trump named Jonathan McKernan, a former F.D.I.C. official, as the patron bureau’s director.

Additional signaling a retreat from enforcement actions, the bureau additionally ended its contracts with various professional witnesses, who consider the proof and testify in instances towards firms, in response to an individual briefed on the matter.

Mr. Vought has lengthy favored abolishing the patron bureau, which focuses on stopping banks and different monetary companies companies from benefiting from clients. One of many final acts the patron bureau took through the Biden administration was to sue Capital One, accusing the financial institution of deceptive customers with guarantees of a high-yielding financial savings account.

The bureau can also be a selected goal of Elon Musk, the tech billionaire, and his group of younger value cutters. Simply final week, in a publish on his social media platform, X, Mr. Musk all however known as for the bureau’s demise. He has been creating a payment platform on X that will be regulated by the bureau.

Securities and Change Fee

On the S.E.C., the performing chair, Mark Uyeda, has been taking purpose at crypto regulation.

His first transfer was to create a crypto job drive that may devise a framework for regulating the unruly business with out relying primarily on enforcement instances.

The duty drive is a rebuff to what the crypto business noticed because the heavy-handed strategy taken by Gary Gensler, the earlier S.E.C. chair.

Mr. Uyeda has additionally moved to scale back the S.E.C.’s crypto enforcement unit, which had been staffed by greater than 50 attorneys and investigators. Some attorneys have been moved to different enforcement groups, and a high lawyer on many crypto instances was moved fully out of the enforcement division — motion appear by some as payback to the crypto neighborhood.

And on Tuesday, Mr. Uyeda knowledgeable a federal appellate courtroom that the company was pausing its protection of a rule that will require public firms to reveal how their operations affect climate change. Many U.S. firms have complained that the rule is simply too pricey to hold out. Supporters of local weather disclosures think about the rule amongst Mr. Gensler’s signature achievements.

Mr. Trump’s regulatory rollback additionally probably extends to the S.E.C.’s enforcement of company corruption abroad. On Monday, he signed an government order directing Lawyer Common Pam Bondi to pause enforcement of the International Corrupt Practices Act, which makes it unlawful for U.S. firms to bribe international officers to get authorities contracts, and is enforced by each the S.E.C. and Division of Justice. One of many greatest international bribery instances in recent times was an investigation that led to a Goldman Sachs subsidiary’s entering a guilty plea within the 1MDB scandal.

Equal Employment Alternative Fee

On the E.E.O.C., the federal company centered on defending workers from discrimination, instances associated to transgender staff are actually doubtful.

Final month, attorneys for the company requested a decide to pause litigation in a case accusing a hog farm of discriminating towards a transgender worker, together with by failing to cease one other employee from attempting to grope her breasts and expose his personal genitalia. The pause within the case, attorneys informed the decide, “will allow the E.E.O.C. to find out whether or not its continued litigation” is permitted beneath Mr. Trump’s government order associated to “Restoring Organic Fact to the Federal Authorities.”

In a press release, a spokesman for the E.E.O.C. mentioned “the company continues to implement federal antidiscrimination legal guidelines.”

However he added that the company’s performing chair “has acted promptly to adjust to relevant government orders to the fullest extent doable beneath her present authority.”

The order leaves doubtful what is going to occur to different transgender discrimination instances, like one the E.E.O.C. introduced in September towards a series of motels. The fee charged the businesses with illegally firing a transgender housekeeper who complained about being subjected to harassment.

In asserting that lawsuit, a regional E.E.O.C. legal professional mentioned: “Stopping and remedying discrimination towards L.G.B.T.Q.I.+ people stay key priorities for the E.E.O.C.”

However Mr. Trump has made it clear that he has different priorities. Shortly after issuing the “organic fact” government order, the Trump administration fired two of the company’s Democratic commissioners and its common counsel.

Stacy Cowley contributed reporting.