Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Financial forecasting has by no means been a straightforward activity, and it turns into much more difficult when confronted with unprecedented financial occasions like COVID-19 lockdowns and unparalleled ranges of presidency intervention, adopted by a speedy cycle of rate of interest hikes.

Look no additional than current mortgage charge forecasts. Final 12 months marked the third 12 months in a row that mortgage charges ended the 12 months increased than forecasters anticipated.

Will they lastly get it proper this 12 months?

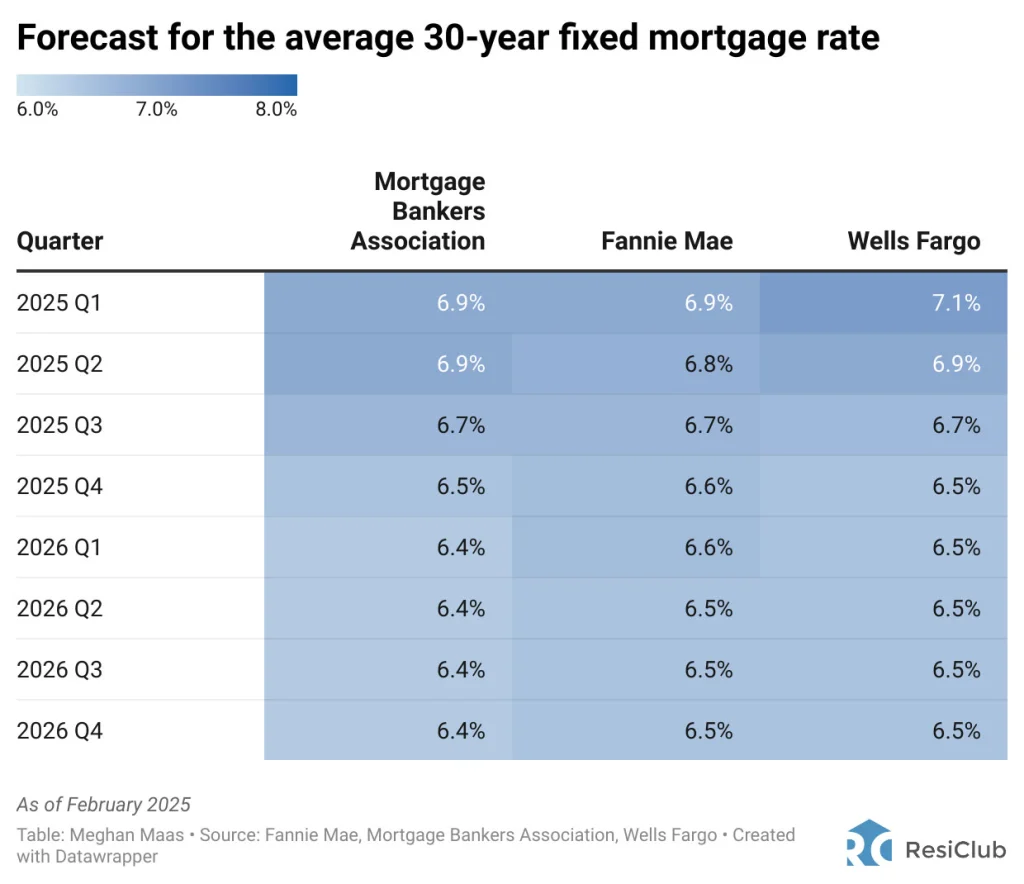

ResiClub’s newest roundup of quarterly mortgage charge forecasts reveals that almost all forecasters nonetheless anticipate mortgage charges to progressively lower over the following 18 months.

The common 30-year fastened mortgage charge as of Thursday was 6.96%.

By the ultimate quarter of 2025, Fannie Mae expects that to slip to six.6%. In the meantime, Wells Fargo’s mannequin expects 6.5%, and the Mortgage Bankers Affiliation estimates 6.5%.

However even when these forecasts are proper, it could imply that housing affordability would nonetheless stay strained in 2025 and 2026.